The patent was acquired in January 2019 and has a useful life of 10 years. The franchise was acquired in January 2016 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2020

| Jan. 2 | Paid $27,000 legal costs to successfully defend the patent against infringement by another company. |

| Jan.-June | Developed a new product, incurring $140,000 in research and development costs. A patent was granted for the product on July 1. Its useful life is equal to its legal life. |

| Sept. 1 | Paid $50,000 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials will air in September and October. |

| Oct. 1 | Acquired a franchise for $140,000. The franchise has a useful life of 50 years. |

Instructions

- Prepare journal entries to record the transactions above.

- Prepare journal entries to record the 2020 amortization expense.

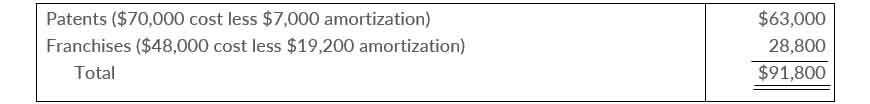

- Prepare the intangible assets section of the balance sheet at December 31, 2020.

Solution

Journal Entries

Journal Entries for the 2020 amortization expense

Intengible assets