On May 1, 2019, Herron Corp. issued $600,000, 9%, 5-year bonds at face value. The bonds were dated May 1, 2019, and pay interest annually on May 1. Financial statements are prepared annually on December 31

Instructions

- Prepare the journal entry to record the issuance of the bonds.

- Prepare the adjusting entry to record the accrual of interest on December 31, 2019.

- Show the balance sheet presentation on December 31, 2019.

- Prepare the journal entry to record payment of interest on May 1, 2020.

- Prepare the adjusting entry to record the accrual of interest on December 31, 2020.

- Assume that on January 1, 2021, Herron pays the accrual bond interest and calls the bonds. The call price is 102. Record the payment of interest and redemption of the bonds

Kershaw Electric sold $6,000,000, 10%, 10-year bonds on January 1, 2019. The bonds were dated January 1, 2019, and paid interest on January 1. The bonds were sold at 98.

Instructions

- Prepare the journal entry to record the issuance of the bonds on January 1, 2019.

- At December 31, 2019, $8,000 of the Discount on Bonds Payable account has been amortized. Show the balance sheet presentation of the long-term liability at December 31, 2019. .

- On January 1, 2021, when the carrying value of the bonds was $5,896,000, the company redeemed the bonds at 102. Record the redemption of the bonds assuming that interest for the period has already been paid.

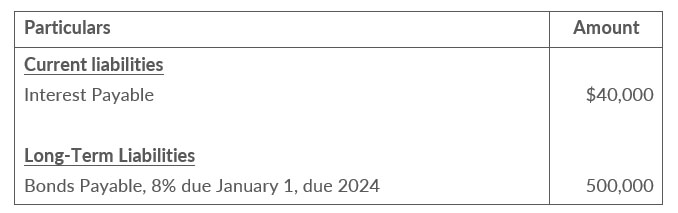

The following section is taken from Mareska's balance sheet at December 31, 2020.

Bond interest is payable annually on January 1. The bonds are callable on any annual interest date.

Instructions

- Journalize the payment of the bond interest on January 1, 2021.

- Assume that on January 1, 2021, after paying interest, Ohlman calls bonds having a face value of $600,000. the call price is 103, Record the redemption of the bonds.

- Prepare the adjusting entry on December 31, 2021, to record the accrual of interest on the remaining bonds.

Talkington Electronics issues a $400,000, 8%, 15-year mortgage note on December 31, 2018. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $59,612. Payments are due on December 31.

Instructions

- Prepare an installment payments schedule for the first 4 years.

- Prepare the entries for (1) the loan and (2) the first installment payment.

- Show how the total mortgage liability should be reported on the balance sheet at December 31, 2019.

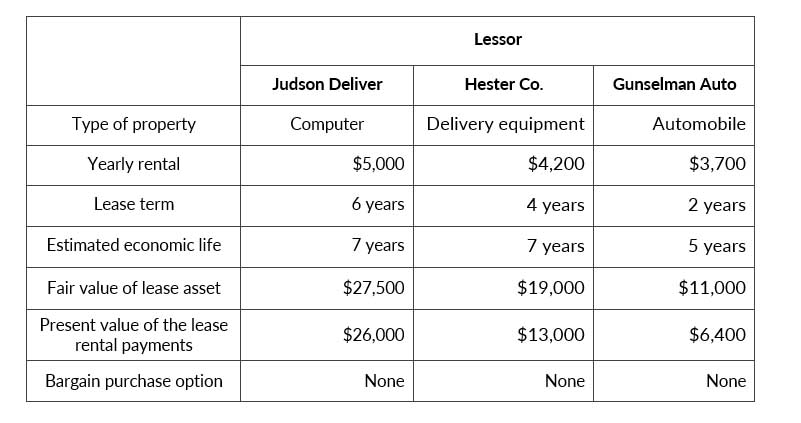

Presented below are three different lease transactions that occurred for Ruggiero Inc. in 2020. Assume that all lease contracts start on January 1, 2020. In no case does Ruggiero receive title to the properties leased during or at the end of the lease term.

Instructions

- Which of the leases are operating leases and which are capital leases? Explain.

- How should the lease transaction for Hester Co. be recorded in 2020.

- How should the lease transaction for Judson Delivery be recorded on January 1, 2020?

Paris Electric sold $3,000,000, 10%, 10-year bonds on January 1, 2019. The bonds were dated January 1 and pay interest annually on January 1. Paris Electric uses the straight-line method to amortize bond premium or discount. The bonds were sold at 104.

Instructions

- Prepare the journal entry to record the issuance of the bonds on January 1, 2019.

- Prepare a bond premium amortization schedule for the first 4 interest periods.

- Prepare the journal entries for interest and the amortization for the premium in 2019 and 2020.

- Show the balance sheet presentation of the bond liability at December 31, 2020.

Saberhagen Company sold $3,500,000, 8%, 10-year bonds on January 2020. The bonds were dated January 1, 2020 and pay interest annually on January Saberhagen Company uses the straight-line method to amortize bonds premium or discount.

Instructions

- Prepare all the necessary journal entries to record the issuance of the bonds and bond interest expense for 2020, assuming that the bonds sold at 104.

- Prepare journal entries as ain part (a) assuming that the bonds sold at 98.

- Show balance sheet presentation for the bonds at December 31, 2020, for both the requirements in (a) and (b).

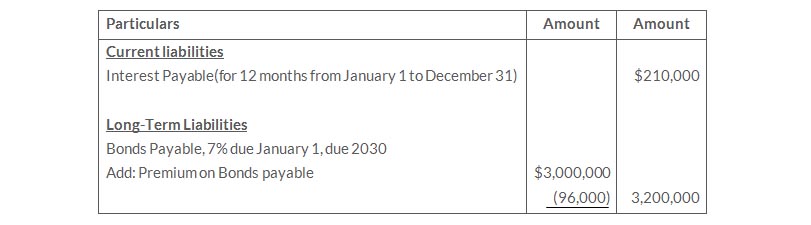

The following is taken from the Colaw Company balance sheet.

Interest is payable annually on January 1. The bonds are callable on any annual interest date. Colaw uses straight-line amortization for any bond premium or discount. From December 31, 2019, the bonds will be outstanding for an additional 10 years (120 months).

Instructions

- Journalize the payment of bond interest on January 1, 2020.

- Prepare the entry to amortize bond premium and to accrue the interest due on December 31, 2020.

- Assume that on January 1, 021, after paying interest, Colaw Company calls bonds having a face value of $1,200,000. the call price is 101. Record the redemption of the bonds.

- Prepare the adjusting entry at December 31, 2021, to amortize bond premium and to accrue interest on the remaining bonds.

On January 1, 2021, Lock Corporation issued $1,800,000 face value, 5%, 10-year bonds at $1,667,518. This price resulted in an effective-interest rate of 6% on the bonds. Lock uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest January 1.

Instructions

- Prepare the journal entry to record the issuance of the bonds on January 1, 2021.

- Prepare an amortization table through December 31, 2023 (three interest periods) for this bond issue.

- Prepare the journal entry to record the accrual of interest and the amortization of the discount on December 31, 2021.

- Prepare the journal entry to record the payment of interest on January 1, 2022.

- Prepare the journal entry to record the accrual of interest and the amortization of the discount December 31, 2022..

On January 1, 2021, Jade Company issued $2,000,000 face value, 7%, 10-year bonds at $2,147,202. This price resulted in a 6% effective-interest rate on the bonds. Jade uses the effective-interest method to amortize bond premium or discount. The bonds pay annual interest on each January 1.

Instructions

- Prepare the journal entries to record the following transactions.

- The issuance of the bonds on January 1, 2021.

- Accrual of interest and amortization of the premium on December 31, 2021.

- The payment of interest on January 1, 2022.

- Accrual of interest and amortization of the premium on December 31, 2022.

- Show the proper long-term liabilities balance sheet presentation for the liability for bonds payable at December 31, 2022.

- Provide the answers to the following questions in narrative form

- What amount of interest expense is reported for 2022?

- Would the bond interest expense reported in 2022 be the same as, greater than, or less than the amount that would be reported if the straight-line method of amortization were used?