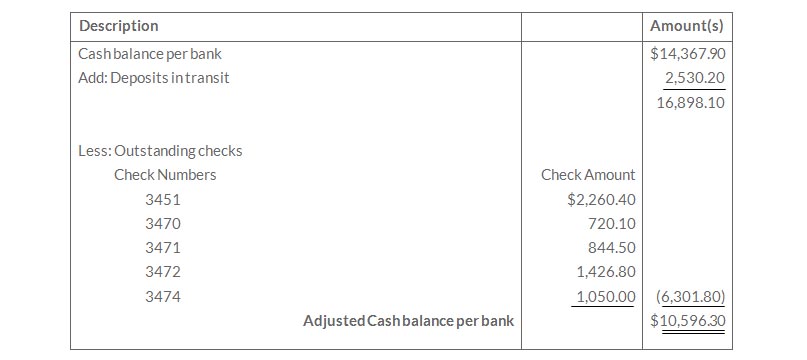

Bank Reconciliation

November 31, 2019

The adjusted cash balance per bank agreed with the cash balance per books at November 30.

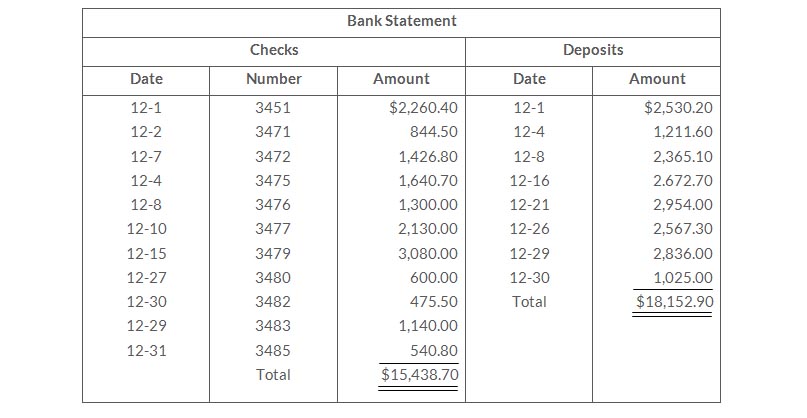

The December bank statement showed the following checks and deposits.

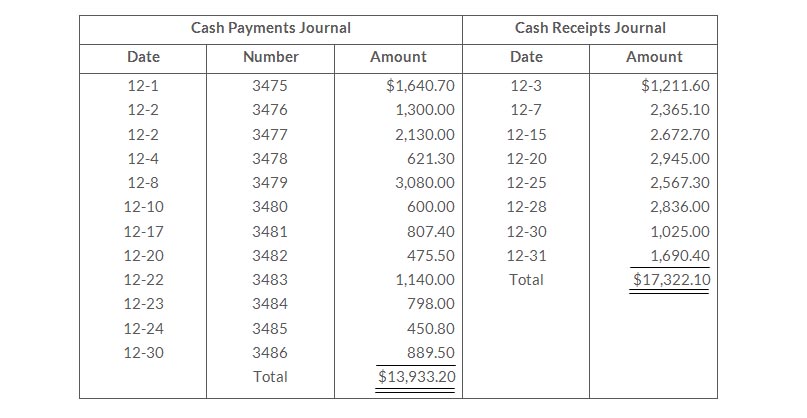

The cash records per books December showed the following.

The bank statement contained two memoranda.

- A credit of $5,145 for the collection of a $5,000 note for Langer Company plus interest of $160 and less a collection fee of $15. Langer Company has not accrued any interest on the note.

- A debit of $572.80 for an NSF check written by L. Rees, a customer At December 31,the check had not been redeposited in the bank.

At December 31, the cash balance per book was $12,485.20, and the cash balance per the bank statement was $20,154.30. The bank did not make any errors, but two errors were made by Langer Company.

Instructions

- Using the four steps in the reconciliation, prepare a bank reconciliation at December 31.

- Prepare the adjusting entries based on the reconciliation.

- The statement included a debit memo of $40 for the printing of additional company checks.

- Cash sales of $836.15 on May 12 were deposited in the bank. the cash receipts journal entry and the deposit slip were incorrectly made for $886.15. The bank credited Reber Company for the correct amount.

- Outstanding checks at May 31 totaled $576.25. Deposits in transit were $2,416.15.

- On may 18, the company issued check No. 1181 for $685 to Lynda Carsen on account. The check, which cleared the bank in May, was incorrectly journalized and posted by Reber company for $658.

- A $3,000 note receivable was collected by the bank for Reber Company on May 31 plus $80 interest. The bank charged a collection fee of $20. no interest has been accrued on the note.

- Included with the cancelled checks was a check issued by Stiner Comapny to Ted Cress for $800 that was incorrectly charged to Reber Company by the bank.

- On May 31, the bank statement showed an NSF charge of $680 for a check issued by Sue Allison, a customer, to Reber Company on account.

Instructions

- Prepare the bank reconciliation at May 31, 2019.

- Pprepare the necessary adjusting entries for Reber Company at May 31, 2019.

| July 1 | Established petty cash fund by writing a check on Scranton Bank for $200. |

| 15 | Replenished the petty cash fund by writing a check for $196.00. On this date the fund consisted of $4.00 in cash and the following petty cash receipts; freight-out $92.00, postage expense $42.40, entertainment expense $46.60, and miscellaneous expense $11.20. |

| 31 | Replenished the petty cash fund by writing a check for $192.00. At this date the fund consisted of $8.00 in cash and the following petty cash receipts: freight-out $82.10, charitable contributions expense $45.00, postage expense $25.50, and miscellaneous expense $39.40.. |

| Aug. 15 | Replenished the petty cash fund by writing a check for $187.00. On this date, the fund consisted of $13,00 in cash and the following petty cash receipts: freight-out $77.60, entertainment expense $43,00, postage expense $33,00, and miscellaneous expense $37.00. |

| 16 | Increased the amount of the petty cash fund to $300 by writing a check for $100. |

| 31 | Replenished the petty cash fund by writing a check for $284.00. On this date, the fund consisted of $16 in cash and the following petty cash receipts: postage expense $140.00, travel expense $95.60, and freight-out $47.10. |

Instructions

- Journalize the petty cash transactions.

- Post to the Petty Cash account.

- What internal control features exist in a petty cash fund?

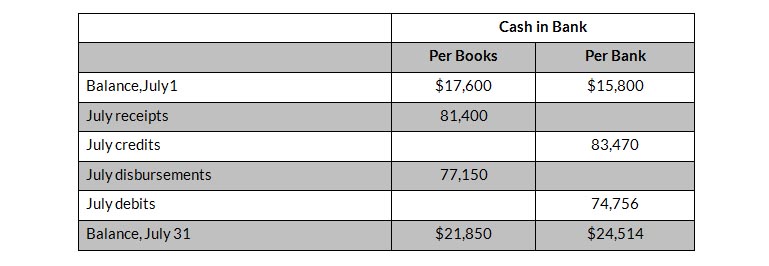

Analysis of the bank data reveals that the credits consist of $79,000 of July deposits and a credit memorandum of $4,470 for the collection of a $4,400 note plus interest revenue of $70.The July debits per bank consist of checks cleared $74,700 and a debit memorandum of $56 for printing additional company checks.

The following errors involving July checks.(1) A check for $230 to a creditor on account that cleared the bank in July was journalized and posted as $320.(2) A salary check to an employee for $255 was recorded by the bank for $155.

The June 30 bank reconciliation contained only two reconciling items: deposits in transit $8,000 and outstanding checks of $6,200.

Instructions

- Prepare a bank reconciliation at July 31,2019.

- Journalize the adjusting entries to be made by Rodriguez Company. Assume that interest on the note has not been accrued.

- June 1: Cash in fund $1.75, Receipts: delivery expense $31.25, postage expense $39.00, and miscellaneous expense $25.00.

- July 1: Cash in fund $3.25, Receipts: delivery expense $21.00, entertainment expense $51.00, and miscellaneous expense $24.75.

- Only July 10, Setterstrom increased the fund from $100 to $130.

Instructions

Prepare journal entries for Setterstrom Company for May 1, June 1, July 1, and July 10.

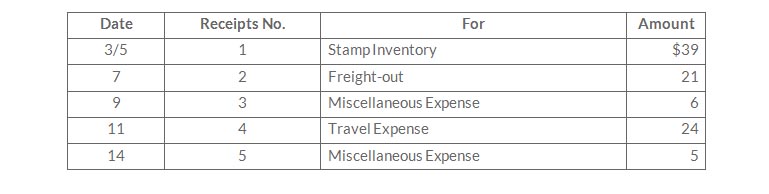

The fund was replenished on March 15 when the fund contained $2 in cash. On March 20, the amount in the fund was increased to $175.

Instructions

Prepare the entries in March that pertain to the operation of the petty cash fund.

Instructions

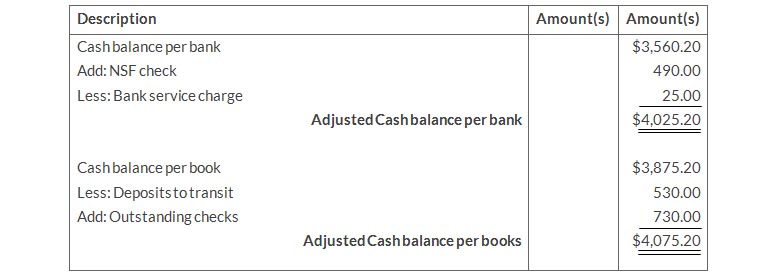

- Prepare the bank reconciliation

- Pprepare the necessary adjusting entries required by the reconciliation.

Instructions

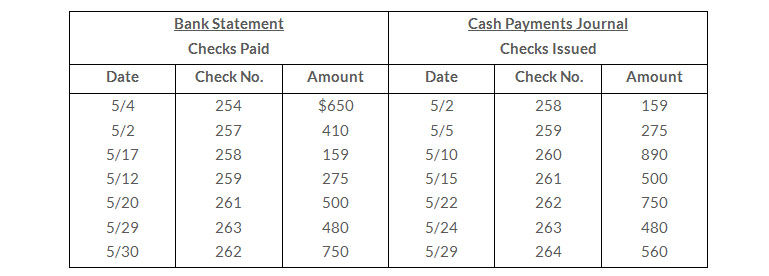

Using reconciliation procedure, list the outstanding checks at May 31

- Cash balance per bank, July 31, $7,263.

- July bank service chrge not recorded by the depositor $28.

- Cash balance per books, July 31, 7,284.

- Deposits in transit, July 31, $1,300.

- Bank collected $700 note for Crane in July, plus interest $36, less fee $20. The collection has note been recorded by Crane, and no interest has been accrued.

- Outstanding checks, July 31, $591.

Instructions

- Prepare a bank reconciliation at July 31.

- Journalize the adjusting entries at July 31 on the books of Crane Video Company.

- Balance September 1-$17,150; Cash deposited-$64,000.

- Balance September 30-$17,404; Cash written-$63,746.

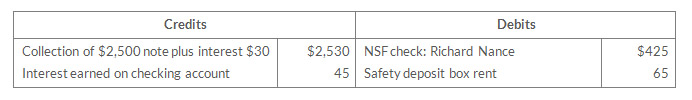

The September bank statement shows a balance of $16,422 on September 30 and the following memoranda.

At September 30, deposits in transit were $5,450, and outstanding checks totaled $2,383.

Instructions

- Prepare the bank reconciliation at September 30.

- Prepare the adjusting entries at September 30, assuming (1) the NSF check was from a customer on account, ad (2) no interest had been accrued on the note.