Worksheet

For the Year Ended December 31, 2019

Instructions

- Complete the worksheet by extending the balances to the financial statement columns.

- Prepare an income statement, owner's equity statement, and a classified balance sheet.(Note: $5,000 of the notes payable become due in 2020.) D. Thao did not make any additional investments in the business during the year.

- Prepare the closing entries. Use J14 for the journal page.

- Post the closing entries. Use the three-column form of account. Income Summary is No. 350.

- Prepare a post-closing trial balance.

Solution

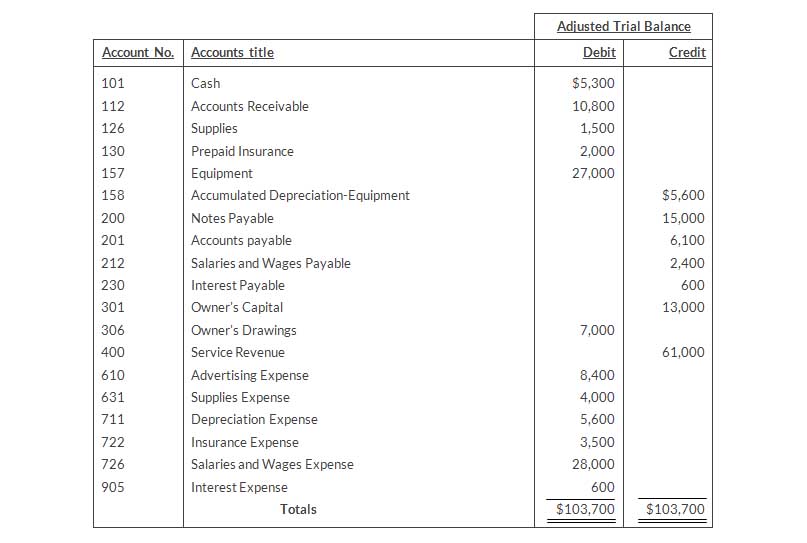

Worksheet

For the Year Ended December 31, 2019

Income Statement

For the Year Ended December 31, 2019

Owner's Equity Statement

For the Year Ended December 31, 2019

Thao Company

Balance Sheet

December 31, 2019

Closing Journal Entries

Ledger Entries (Three-Column Form)

Post-Closing Trial Balance

December 31, 2019