| Accounts receivable | $960,000 |

| Less: Allowance for doubtful accounts | 80,000 |

During 2019, the company had the following transactions related to receivables.

| 1 | Sales on account | $3,700,000 |

| 2 | Sales returns and allowances | 50,000 |

| 3 | Collections of accounts receivable | 2,810,000 |

| 4 | Write-offs of accounts receivable deemed noncollectable | 90,000 |

| 5 | Recovery of bad debts previously written off as noncollectable | 29,000 |

Instructions

- Prepare the journal entries to record each of these five transactions. Assume that no cash discounts were taken on the collections of accounts receivable.

- Enter the January 1,2019, balances in Accounts Receivable and Allowances for Doubtful Accounts, post the entries to the tow accounts (use T-accounts), and determine the balances.

- Prepare the journal entry to record bad dbt expense for 2019, assuming that an aging of accounts receivable indicates that expected bad debts are $115,000.

- Compute the accounts receivable turnover for 2019 assuming the expected bad debt information provided in (c).

| Total credit sales | $2,500,000 |

| Accounts receivable at December 31 | 875,000 |

| Bad debts written off | 33,000 |

Instructions

- What amount of bad debt expense will Mingenback Company report if it uses the direct write-off method of accounting for bad debts?

- Assume that Mingenback Company estimates its bad debt expense to be 2% of credit sales. What amount of bad debt expense will Mingenback record if it has an Allowance of Doubtful Accounts credit balance of $4,000?

- Assume that Mingenback Company estimates its bad debt expense based on 6% of has an Allowance for Doubtful Accounts credit balance of $3,000?

- Assume the same facts as in (c), except that there is a $3,000 debit balance in Allowance for Doubtful Accounts. What amount of bad debt expense will Mingenback record?

- What is the weakness of the direct write-off method of reporting bad debt expense?

At December 31, 2019, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $12,000

Instructions

- Journalize and post the adjusting entry for bad debts at December 31, 2019.

- Journalize and post to the allowance account the following events and transactions in the year 2020

- On March 31, a $1,000 customer balance originating in 2019 is judged uncollectible.

- On May 31, a check for $1,000 is received from the customer whose account was written off as uncollectible on March 31.

- Journalize the adjusting entry for bad debts on December 31, 2020, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $800 and the aging schedule indicates that total estimated bad debts will be $31,600

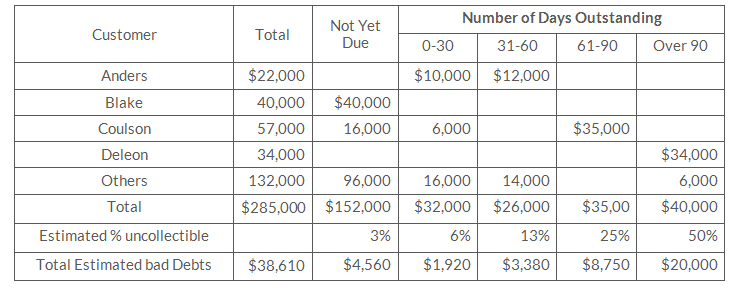

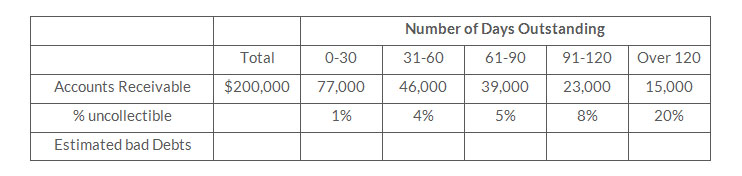

Instructions

- Calculate the total estimated bad debts based on the above information.

- Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectable accounts receivable determined in (a). Assume the current balance in Allowance for Doubtful Accounts is a $8,000 debit.

- Of the above accounts, $5,000 is determined to be specifically uncollectable. Prepare the journal entry to write off the uncollectable account.

- The company collects $5,000 subsequently on a specific account that had previously been determined to be uncollectable in (c). Prepare the journal entry(ies) necessary to restore the account and record the cash collection.

- Comment on how your answers to (a)-(d) would change if Rigney Inc. used 4% of total accounts receivable rather than aging the accounts receivable. What are the advantages to the company of aging the accounts receivable rather than applying a percentage to total accounts receivable?

| Debit | Credit | |

| Account Receivable | $385,000 | |

| Allowance for Doubtful Accounts | $1,000 | |

| Sales Revenue | 970,000 |

Instructions

- Based on the information given, which method of accounting for bad debts is Darby Company using-the direct writ-off method or the allowance method? How cay you tell?

- Prepare the adjusting entry at December 31, 2019, for bad debt expense under each of the followign independent assumptions.

- An aging schedule indicates that $11,750 of accounts receivable will be uncollectible.

- The company estimates that 1% of sales will be uncollectible.

- Repeat part (b) assuming that instead of a credit balance there is a $1,000 debit balance in allowance for Doubtful Accounts.

- During the next month, January 2020, a $3,000 account receivable is written off as uncollectible. Prepare the Journal entry to record the write-off.

- Repeat part (d) assuming that Darby uses the direct write-off method instead of the allowance method in accounting for uncollectible accounts receivable.

- What type of account is Allowance for Doubtful Accounts? How does it affect how accounts receivable is reported on the balance sheet at the end of the accounting period?

| Oct. 7 | Made sales of $6,900 on Farwell credit cards |

| 12 | Made sales of $900 on MasterCard credit cards. The credit card service charge is 3% |

| 15 | Added $460 to Farwell customer balances for finance charges on unpaid balances |

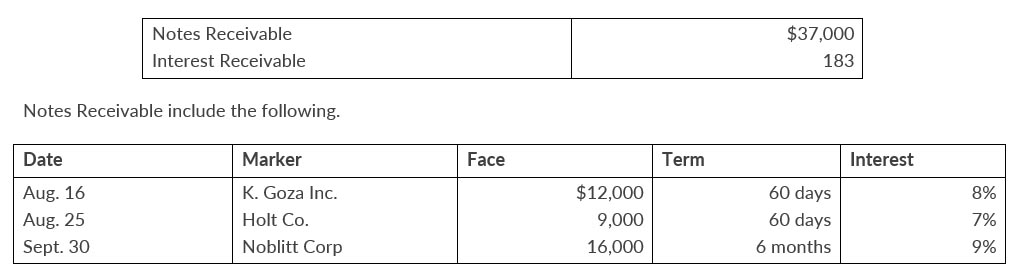

| 15 | Received payment in full from K. Goza Inc. on the amount due. |

| 24 | Received notice that the Holt note has been dishonored. (Assume that Holt is expected to pay in the future |

Instructions

- Journalize the October transactions and the October 31 adjusting entry for accrued interest receivable.

- Enter the balances at October 1 in the receivable accounts. Post the entries to all of the receivable accounts. There was no opening balance in accounts receivable.

- Show the balance sheet presentation of the receivable accounts at October 31

| Jan. 5 | Sold $20,000 of merchandise to Sheldon Company, terms n/15. |

| Jan. 20 | Accepted Sheldon Company's $20,000, 3-month, 8% note for balance due. |

| Feb. 18 | Sold $8,000 of merchandise to Patwary Company and accepted Patwary's $8,000, 6-month, 9% note for the amount due |

| Apr. 20 | Collected Sheldon Company note in full. |

| Apr. 30 | Received payment in full from Willingham company on the amount due. |

| May 25 | Accepted Potter Inc.'s $6,000, 3-month, 7% note in settlement of a past-due balance on account. |

| Aug. 18 | Received payment in full from Patwary Company on note due. |

| Aug. 25 | The Potter Inc. note was dishonored Potter Inc. is not bankrupt, future payment is anticipated. |

| Sept. 1 | Sold $12,000 of merchandise to Stanbrough Company and accepted a $12,000, 6-month, 10% note for the amount due. |

Instructions

Journalize the transactions.

| Jan. 1 | Winter accepted a 4-month, 8% note from Merando Company in payment of Merando's $1,200 account |

| 3 | Winter wrote off as uncollectible the accounts of Inwood Corporation ($450) and Goza Company ($280). |

| 8 | Winter purchased $17,200 of inventory on account. |

| 11 | Winter sold for $28,000 on account inventory hat cost $19,600. |

| 15 | Winter sold inventory that cost $700 to Mark Lauber for $1,000. Lauber charged this amount on his Visa First Bank card. The service free charged Winter by First Bank is 3% |

| 17 | Winter collected $22,900 from customers on account. |

| 21 | Winter paid $14,300 on accounts payable. |

| 24 | Winter received payment in full ($280) from Goza Company on the account written off an January 3. |

| 27 | Winter purchased supplies for $1,400 cash. |

| 31 | Winter paid other operating expenses $3,718. |

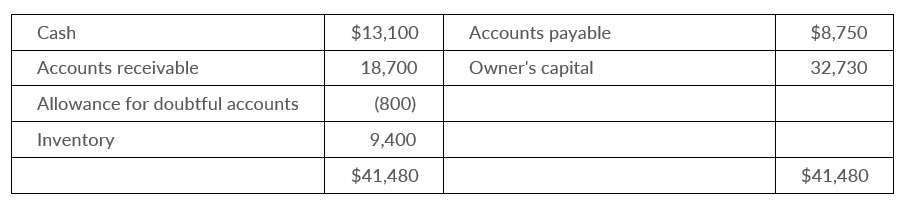

Instructions

- Prepare journal entries for the transactions listed above and adjusting entries.(Include entries for cost of goods sold using the perpetual system.

- Prepare an adjusted trial balance at January 31,2021.

- Prepare an income statement and an owner's equity statement for the month ending January 31, 2021, and a classified balance sheet as of January 31, 2021.

| March 1 | Sold merchandise on account to Dodson Company for $5,000, terms 2/10, n/30. |

| 3 | Dodson Company returned merchandise worth $500 to Molina. |

| 9 | Molina collected the amount due from Dodson Company from the March 1 sale. |

| 15 | Molina sold merchandise for $400 in its retail outlet. The customer used his Molina credit card. |

| 31 | Molina added 1.5% monthly interest to the customer's credit card balance. |

Instructions

Prepare journal entries for the transactions above.

- On January 6, Brumbaugh Co. sells merchandise on account to Pryor Inc. for $7,000, terms 2/10, n/30. On January 16, Pryor Inc. pays the amount due. Prepare the entries on Brumbaugh's books to record the sale and related collection.

- On January 10, Andrew Farley uses his Paltrow Co. credit card to purchase merchandise from Paltrow Co. for $9,000. On February 10, Farley is billed for the amount due of $9,000. On February 12, Farley pays $5,000 on the balance due. On March 10, Farley is billed for the amount due, including interest at 1% per month on the unpaid balance as of February 12. Prepare the entries on Paltrow Co's books related to the transactions that occurred on January 10, February 12, and March 10.