| Fixed Overhead Costs | Variable Overhead Costs | ||

| Supervision | $96,000 | Indirect labor | $126,000 |

| Depreciation | 72,000 | Indirect materials | 90,000 |

| Insurance | 30,000 | Repairs | 69,000 |

| Rent | 24,000 | Utilities | 72,000 |

| Property taxes | 18,000 | Lubricants | 18,000 |

It is estimated that direct labor hours worked each month will range from 27,000 to 36,000 hours

- During October, 27,000 direct labor hours were worked and the following overhead costs were incurred.

- Fixed overhead costs: supervision $8,000, depreciation $6,000, insurance $2,460, rent $2,0000, and property taxes $1,500

- Variable overhead costs: indirect labor $12,432, indirect materials $7,680, repairs $6,100, utilities $6,840, and lubricants $1,920.

Instructions

- Prepare a monthly manufacturing overhead flexible budget for each increment of 3,000 direct labor hours over the relevant range for the year ending December 31, 2021.

- Prepare a flexible budget report for October.

- Comment on management's efficiency in controlling manufacturing overhead costs in October.

Read more: Problem-1: Budgetary Control and Responsibility Accounting

Read more: Problem-2: Budgetary Control and Responsibility Accounting

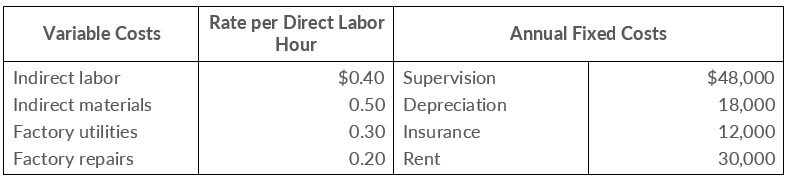

- Variable-per direct labor hour: indirect labor $0.44, indirect materials $0.48, factory utilities $0.32, and factory repairs $0.25.

- Fixed: same as budgeted.

Instructions

- Prepare a monthly manufacturing overhead flexible budget for the year ending December 31, 2021, assuming production levels range from 35,000 to 50,000 direct labor hours. Use increments of 5,000 direct labor hours.

- Prepare a budget report for June comparing actual results with budget data based on he flexible budget.

- Were costs effectively controlled? Explain.

- State the formula for computing the total budgeted costs for the ironing Department

- Prepare the flexible budget graph, showing total budgeted costs at 35,000 and 45,000 direct labor hours. Use increments of 5,000 direct labor hours on the horizontal axis and increments of $10,000 on the vertical axis

Read more: Problem-3: Budgetary Control and Responsibility Accounting

Read more: Problem-4: Budgetary Control and Responsibility Accounting

Read more: Problem-5: Budgetary Control and Responsibility Accounting

Read more: Problem-6: Budgetary Control and Responsibility Accounting

Read more: Problem-7: Budgetary Control and Responsibility Accounting

Read more: Problem-8: Budgetary Control and Responsibility Accounting

Read more: Problem-9: Budgetary Control and Responsibility Accounting

Read more: Problem-10: Budgetary Control and Responsibility Accounting