On April 1, the accounts receivable ledger of Kozma Company showed the following balances: Morrow $1,550, Rose $1,200, Jennings Co. $2,900, and Dent $2,200. The April transactions involving the receipt of cash were as follows.

| Apr. 1 | The owner, T. Kozma, invested additional cash in the business $7,200 |

| 4 | Received check for payment of account from Dent less 2% cash discount. |

| 5 | Received check for $920 in payment of invoice no. 307 from Jennings Co. |

| 8 | Made cash sales of merchandise totaling $7,245. The cost of the merchandise sold was $4,347. |

| 10 | Received check for $600 in payment of invoice no. 309 from Morrow |

| 11 | Received cash refund from a supplier for damaged merchandise $740. |

| 23 | Received check for $1,000 in payment of invoice no. 310 from Jennings Co. |

| 29 | Received check for payment of account from Rose (no cash discount allowed). |

Instructions

- Journalize the transactions above in a six-column cash receipts journal with columns for Cash Dr., Sales Discounts Dr., Accounts Receivable Cr., Sales Revenue Cr., Other Accounts Cr., and Cost of Goods Sold Dr/Inventory Cr. Foot and cross-foot the journal.

- Insert the beginning balances in the Accounts Receivable control and subsidiary accounts, and post the April transactions to these accounts.

- Prove the agreement of the control account and subsidiary account balances.

On October 1, the accounts payable ledger of Reineke Company showed the following balances: Uggla Company $2,700, Orr Co. $2,500, Rosenthal Co. $1,800, and Clevenger Company $3,700. The October transactions involving the payment of cash were as follows.

| Oct. 1 | Purchased merchandise, check no. 63, $300. |

| 3 | Purchased equipment, check no. 64, $800. |

| 5 | Paid Uggla Company balance due of $2,700, less 2% discount, check no. 65, $2,646. |

| 10 | Purchased merchandise, check no. 66, $2,550. |

| 15 | Paid Rosenthal Co. balance due of $1,800, check no. 67. |

| 16 | Reineke, the owner, pays his personal insurance premium of $400, check no. 68. |

| 19 | Paid Orr Co. in full for invoice no. 610, $2,000 less 2% discount, check no. 69, $1,960. |

| 29 | Paid Clevenger Company in full for invoice no. 264, $2,500, check no. 70. |

Instructions

- Journalize the transactions above in a four-column cash payments journal with columns for Other Accounts Dr., Accounts Payable Dr., Inventory Cr., and Cash Cr. Foot and cross-foot the Journal.

- Insert the beginning balances in the Accounts Payable control and subsidiary accounts, and post the October transactions to these accounts.

- Prove the agreement of the control account and subsidiary account balances.

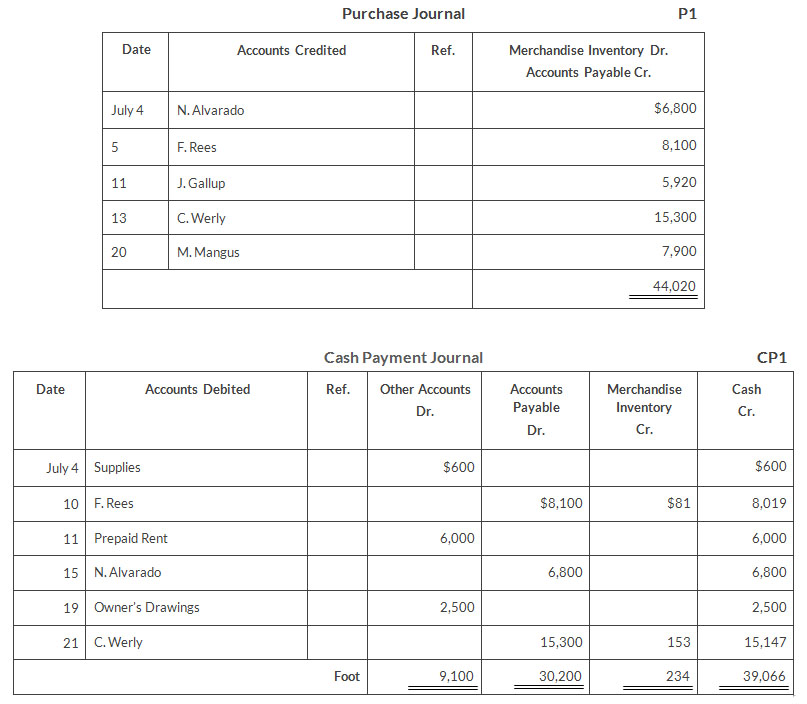

In July the following selected transactions were completed. All purchases and sales were on account. The cost of all merchandise sold was 70% of the sales price.

| July 1 | Purchased merchandise from Eby Company $8,000. |

| 2 | Received freight bill from Shaw Shipping on Eby purchase $400 |

| 3 | Made sales to Fort Company $1,300 and to Hefner Bros. $1,500. |

| 5 | Purchased merchandise from Getz Company $3,200. |

| 8 | Received Credit on merchandise returned to Getz Company $300. |

| 13 | Purchased store supplies from Dayne Supply $720. |

| 15 | Purchased merchandise from Eby Company $3,600 and from Bosco Company $4,300. |

| 16 | Made sales to Aybar Company $3,450 and to Hefner Bros. $1,870. |

| 18 | Received bill for advertising from Welton Advertisements $600. |

| 21 | Sales were made for Fort Company $310 and to Duncan Company $2,800. |

| 22 | Granted allowance to Fort Company for merchandise damaged in shipment $40. |

| 24 | Purchased merchandise from Getz Company $3,000. |

| 26 | Purchased equipment from Dayne Supply $900. |

| 28 | Received freight bill from Shaw Shipping on Getz purchased of July 24, $380. |

| 30 | Sales were made to Aybar Company $5,600. |

Instructions

- Journalize the transactions above in a purchased journal, a sales journal, and a general journal. The purchases journal should have the following column headings: Date, Account Credited (Debited), Ref., Accounts Payable Cr., Inventory Dr., and Other Accounts Dr.

- Post to both the general and subsidiary ledger accounts. (Assume that all accounts have zero beginning balances.)

- Prove the agreement of the control and subsidiary accounts.

The cost of all merchandise sold was 60% of the sales price. During January, Mercer completed the following transactions.

| Jan. 3 | Purchased merchandise on account to from Gallagher Co. $9,000. |

| 4 | Purchased supplies for cash $80. |

| 4 | Sold merchandise on account to Wheeler $5,250, invoice no. 371, terms 1/10, n/30 |

| 5 | Returned $300 worth of damaged goods purchased on account from Gallagher Co. on January 3. |

| 6 | Made cash sales for the week totaling $3,150. |

| 8 | Purchased merchandise on account from Phegle Co. $4,500. |

| 9 | Sold merchandise on account to Linton Corp. $5,400, Invoice no. 372, terms 1/10, n/30. |

| 11 | Purchased merchandise on account from Cora Co. $3,700. |

| 13 | Paid in full Gallagher Co. on account less a 2% discount. |

| 13 | Made cash sales for the week totaling $6,260. |

| 15 | Received payment from Linton Corp. for invoice no. 372. |

| 15 | Paid semi-monthly salaries of $14,300 to employees. |

| 17 | Received payment from Wheeler for invoice no. 371. |

| 17 | Sold merchandise on account to Delaney Co. $1,200, invoice no. 373, terms 1/10, n/30. |

| 19 | Purchased equipment on account from Dozier Corp. $5,500. |

| 20 | Cash Sales for the week totaled $3,200. |

| 20 | Paid in full Phegley Co. on account less a 2% discount. |

| 23 | Purchased merchandise on account from Gallagher Co. $7,800. |

| 24 | Purchased merchandise on account from Atchison Corp. $5,100. |

| 27 | Made cash sales for the week totaling $4,230. |

| 30 | Received payment from Delaney Co. for invoice no. 373. |

| 31 | Paid semi-monthly salaries of $13,200 to employees. |

| 31 | Sold merchandise on account to wheeler $9,330, invoice no. 374, terms 1/10, n/30 |

- Sales journal.

- Single-column purchases journal.

- Cash receipts journal with columns for cash Dr., Sales Discounts Dr., Accounts Receivable Cr., Sales Revenue Cr., Other Accounts Cr., Cost of Goods Sold Dr., and Inventory Cr.

- Cash payments journal with columns for Other Accounts Cr., Accounts Payable Dr., Inventory Cr., and Cash Cr.

- General journal.

Instructions

- Record the January transactions in the appropriate journal noted

- Foot and cross-foot all special journals.

- Show how postings would be made by placing ledger account numbers and check-marks as needed in the journals. (Actual posting to ledger accounts is not required.)

| July 1 | The founder, N. Fornelli, invests $80,000 in cash. |

| 6 | Sell merchandise on account to Dow Co. $6,200 terms 1/10, n/30. |

| 7 | Make cash sales totaling $8,000 |

| 8 | Sell merchandise on account to S. Goebel $4,600, terms 1/10, n/30. |

| 10 | Sell merchandise on account to W. Leiss $4,900, terms 1/10, n/30. |

| 13 | Receive payment in full from S. Goebel |

| 16 | Receive payment in full from W. Leiss |

| 20 | Receive payment in full from Dow Co. |

| 21 | Sell merchandise on account to H. Kenney $5,000, terms 1/10, n/30. |

| 29 | Returned damaged goods to N. Alvarado and received cash refund of $420. |

Instructions

- Open the following accounts in the general ledger

- Journalize the transactions that have not been journalized in the sales journal and the cash receipts journal.

- Post to the accounts receivable and accounts payable subsidiary ledgers. Follow the sequence of transactions as shown in the problem.

- Post the individual entries and totals to the general ledger.

- Prepare a trial balance at July 31, 2020

- Determine whether the subsidiary ledgers agree with the control accounts in the general ledger.

- The following adjustments at the end of July are necessary.

- A count of supplies indicates that $140 is still on hand.

- Recognize rent expense for July, $500.

- Prepare an adjusted trial balance at July 31, 2020

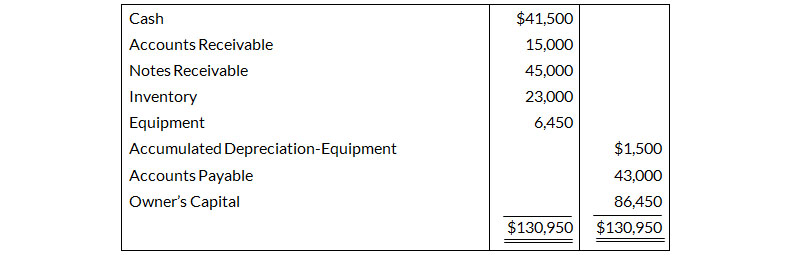

Post-Closing Trial Balance

December 31, 2019.

The transactions for January 2010 are as follows

| Jan. 3 | Sell merchandise to M. Ziesmer $8,000, terms 2/10, n/30.. |

| 5 | Purchase merchandise from E. Pheatt $2,000, terms 2/10, n/30. |

| 7 | Receive a check from T. Hodges $3,500. |

| 11 | Pay freight on merchandise purchased $300. |

| 12 | Pay rent of $1,000 for January. |

| 13 | Receive payment in full from M. Ziesmer. |

| 14 | Post all entries to the subsidiary ledgers. Issued credit of $300 to B. Hannigan for returned merchandise. |

| 15 | Send K. Thayer a check for $12,870 in full payment of account, discount $130. |

| 17 | Purchase merchandise from G. Roland $1,600, terms 2/10, n/30. |

| 18 | Pay sales salaries of $2,800 and office salaries $2,000. |

| 20 | Give D. Danford a 60-day note for $18,000 in full payment of account payable. |

| 23 | Total cash sales amount to $9,100. |

| 24 | Post all entries to the subsidiary ledgers. Sell merchandise on account to I. Kirk $7,400, terms 1/10, n/30. |

| 27 | Send E. Pheatt a check for $950. |

| 29 | Receive payment on a note of $40,000 from B. Stout. |

| 30 | Post all entries to the subsidiary legers. Return merchandise of $300 to G. Roland for credit. |

Instructions

- Open general and subsidiary ledger accounts for the following.

- Record the January transactions in a sales journal, a single-column purchases journal, a cash receipts journal, a cash payments journal, and a general journal.

- Post the appropriate amounts to the general ledger.

- Prepare a trial balance at January 31, 2020

- Determine whether the subsidiary ledgers agree with controlling accounts in the general ledger.

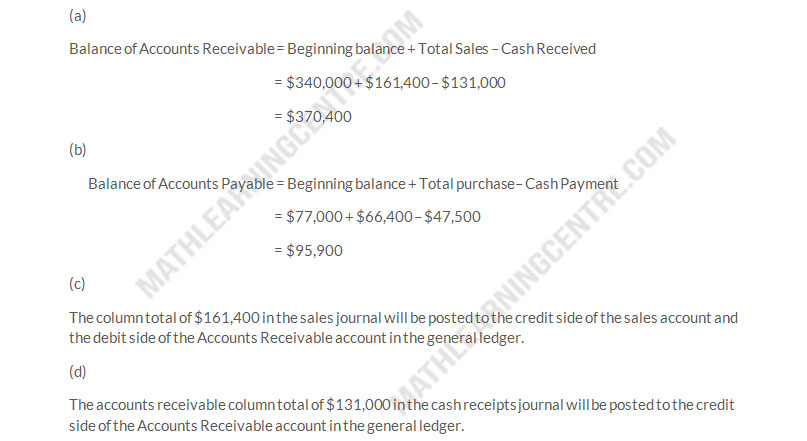

Nex Company uses both special journals and a general journal. On June 30, after all monthly postings had been completed, the Accounts Receivable control account in the general ledger had a debit balance of $340,000, the Accounts Payable control account had a credit balance of $77,000.

| Sales journal | Total sales $161,400 |

| Purchases journal | Total purchases $66,400 |

| Cash receipts journal | Accounts receivable column total $131,000 |

| Cash payments journal | Accounts payable column total $47,500 |

Instructions

- What is the balance of the Accounts Receivable control account after the monthly postings on July 31?

- What is the balance of the Accounts Payable control account after the monthly postings on July 31?

- To what account(s) is the column total of $161,400 in the sales journal posted?

- To what account(s) is the accounts receivable column total of $131,000 in the cash receipts journal posted?

Solution

Instructions

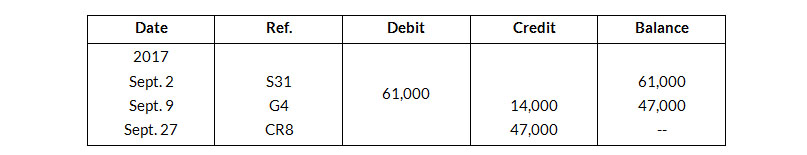

On September 1, the balance of the accounts Receivable control account in the general ledger of Montgomery company was $10,960. The customers' subsidiary ledger contained account balance as follows: Hurley $1,440, Andino $2,640, Fowler $2,060, and Sogard $4,820. At the end of September, the various journals contained the following information.

Sales journal: Sales to Sogard $800, to Hurley $1,260, to Giambi $1,330, and to Fowler $1,600

Cash Receipt journal: Cash received from Fowler $1,310, from Sogard $3,300, from Giami $380, from Andino $1,800, and from Hurley $1,240.

General Journal journal: An allowance is granted to Sogard $220.

Instructions

- Set up control and subsidiary accounts and enter the beginning balances. Do not construct the journals

- Post the various journals. Post the items as individual items or as totals, whichever would be the appropriate procedure. (No sales discounts given.)

- Prepare a schedule of accounts receivable and prove the agreement of the controlling account with the subsidiary ledger at September 30, 2019.

| Credit Sales | Collections | Returns | |

| Bixler Company | $9,000 | $8,000 | $-0- |

| Cuddyer Company | 7,000 | 2,500 | $3,000 |

| Freeze Company | 8,500 | 9,000 | $-0- |

Instructions

- What is the January 1 balance in the Freeze company subsidiary account?

- What is the January 31 balance in the control account?

- Compute the balances in the subsidiary accounts at the end of the month.

- Which January transaction would not be recorded in a special Journal?