Kern's Book Warehouse distributes hardcover looks to retail stores and extends credit terms of 2/10, n/30 to all of its customers. At the end of May, Kern's inventory consisted of books purchased for $1,800. During June, the following merchandising transactions occurred.

| June 1 | Purchased books on account for $1,600 from Binsfeld Publishers, FOB destination, terms 2/10, n/30. The appropriate party also made a cash payment of $50 for the freight on this date. |

| 3 | Sold books on account to Reading Rainbow for $2,500. The cost of the books sold was $1,440. |

| 6 | Received $100 credit for books returned to Binsfeld Publishers. |

| 9 | Paid Binsfeld Publishers in full, less discount. |

| 15 | Received payment in full from Reading Rainbow. |

| 17 | Sold books on account to Rapp Books for $1,800. The cost of the books sold was $1,080. |

| 20 | Purchased books on account for $1,800 from McGinn Publishers, FOB destination, terms 2/15, n/30. The appropriate party also made a cash payment of $60 for the freight on this date. |

| 24 | Received payment in full from Rapp Books. |

| 26 | Paid McGinn Publishers in full, less discount. |

| 28 | Sold books on account to Baeten Bookstore for $1,600. The cost of the books sold was $970. |

| 30 | Granted Baeten Bookstore $120 credit for books returned costing $72 |

Kern's Book Warehouse's chart of accunts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, no. 401 Sales Revenue, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold.

Instructions

Journalize the transactions for the month of June for Kern's Book Warehouse using a perpetual inventory system.

Read more: Problem-1: Accounting for Merchandising Operations

| May 1 | Purchased merchandise on account from Braun's Wholesale Supply $4,200, terms 2/10, n/30. |

| 2 | Sold merchandise on account $2,100, terms 1/10, n/30. The cost of the merchandise sold was $1,300. |

| 5 | Received credit from Braun's Wholesale Supply for merchandise returned $300. |

| 9 | Received collections in full, less discounts, from customers billed on sales of $2,100 on May 2. |

| 10 | Paid Braun's Wholesale Supply in full, less discount. |

| 11 | Purchased supplies for cash $400 |

| 12 | Purchased merchandise for cash $1,400. |

| 15 | received refund for poor quality merchandise from supplier on cash purchase $150. |

| 17 | Purchased merchandise from Valley Distributors $1,300, FOB shipping point, terms 2/10, n/30. |

| 19 | Paid freight on May 17 purchase $130 |

| 24 | Sold merchandise for cash $3,200. The merchandise sold had a cost of $2,000. |

| 25 | Purchased merchandise from Lumley, Inc. $620, FOB destination, terms 2/10, n/30. |

| 27 | Paid Valley Distributors in full, less discount. |

| 29 | Made refunds to cash customers for defective merchandise $70. The returned merchandise had a fair value of $30. |

| 31 | Sold merchandise on account $1,000 terms n/30. The cost of the merchandise sold was $560. |

Runner Hardwere's chart of accounts includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 126 Supplies, No. 201 Accounts Payable, no. 301 Owner's Capital, No. 401 Salves, No. 412 Sales Returns and Allowances, No. 414 Sales Discounts, and No. 505 Cost of Goods Sold.

Instructions

- Journalize the transactions using a perpetual inventory system.

- Enter the beginning cash and capital balances and post the transactions. (use J1 for the journal reference.)

- Prepare an income statement through gross profit for the month of May 2019

Read more: Problem-2: Accounting for Merchandising Operations

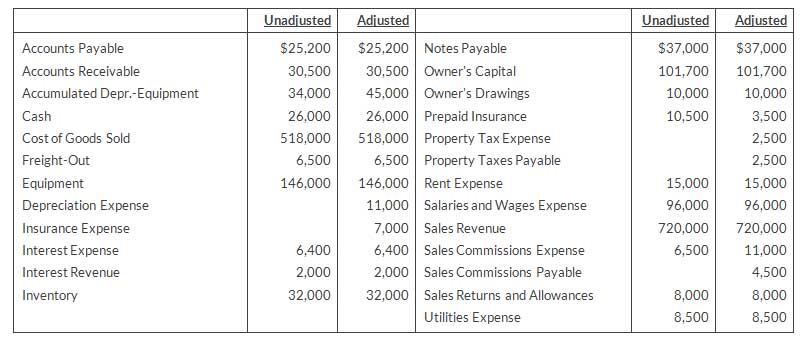

Instructions

- Prepare a multiple-step income statement, and owner's equity statement, and a classified balance sheet. Notes payable are due in 2022

- Journalize the adjusting entries that were made

- Journalize the closing entries that are necessary.

Read more: Problem-3: Accounting for Merchandising Operations

| Apr. 5 | Purchased golf discs, bags, and other inventory on account from Mumford Co. $1,200, FOB shipping point, terms 2/10, n/30. |

| 7 | Paid freight on the Mumford purchase $50. |

| 9 | Received credit from Mumford Co. for merchandise returned $100. |

| 10 | Sold merchandise on account for $900, terms n/30.the merchandise sold had a cost of $540. |

| 12 | Purchased disc golf shirts and other accessories on account from Saucer Sportswear $670, terms 1/10, n30. |

| 14 | Paid Mumford Co. in full, less discount. |

| 17 | Received credit from Saucer Sportswear for merchandise returned $70. |

| 20 | Made sales on account for $610, terms n/30. The cost of the merchandise sold was $370. |

| 21 | Paid Saucer Sportswear in full, less discount. |

| 27 | Granted an allowance to customers for clothing that was flawed $20. |

| 30 | Received payments on account from customers $900. |

The chart of accounts for the store includes the following: No. 101 Cash, No. 112 Accounts Receivable, No. 120 Inventory, No. 201 Accounts Payable, no. 301 Owner's Capital, No. 401 Sales Revenue, No. 412 Sales Returns and Allowances, and No. 505 Cost of Goods Sold.

Instructions

- Journalize the April transactions using a perpetual inventory system.

- Enter the beginning balances in the ledger accounts and post the April transactions. (use J1 for the journal reference.)

- Prepare a trial balance on April 30, 2019.

Read more: Problem-4: Accounting for Merchandising Operations

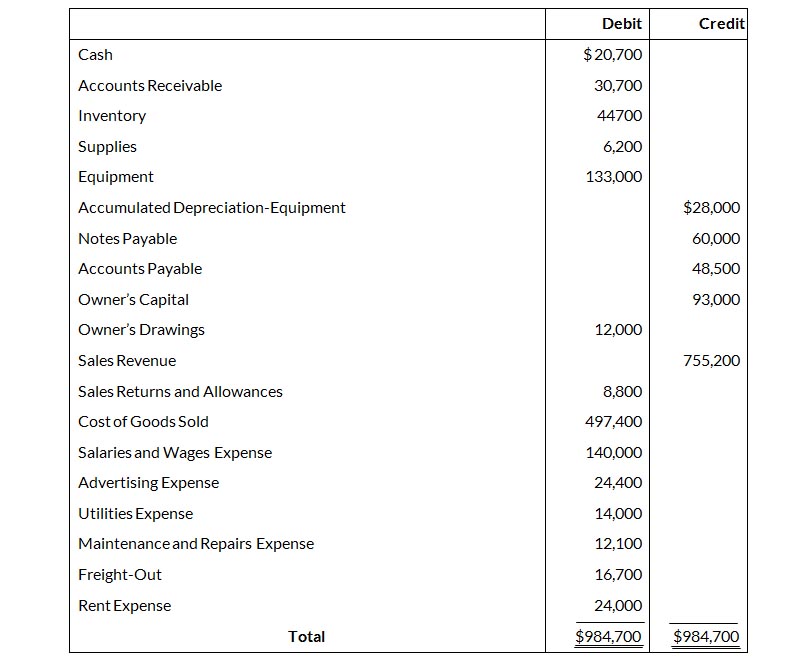

Adjustment data:

- Supplies on hand totaled $2,600.

- Depreciation is $ 11,500 on the equipment.

- Interest of $3,800 is accrued on notes payable at November 30.

- Inventory actually on hand is $44,400.

Instructions

- Enter the trial balance on a worksheet, and complete the worksheet.

- Prepare a multiple-step income statement and an owners equity statement for the year, and a classified balance sheet as of November 30, 2019. Notes payable of $20,000 are due in January 2020.

- Journalize the adjusting entries.

- Journalize the closing entries.

- Prepare a post-closing trial balance.

Read more: Problem-5: Accounting for Merchandising Operations

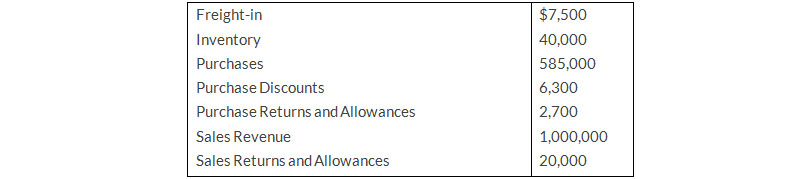

- Merchandise inventory on November 30, 2019, is $52,600.

- Donaldson Department Store uses a periodic system.

Instructions

Read more: Problem-6: Accounting for Merchandising Operations

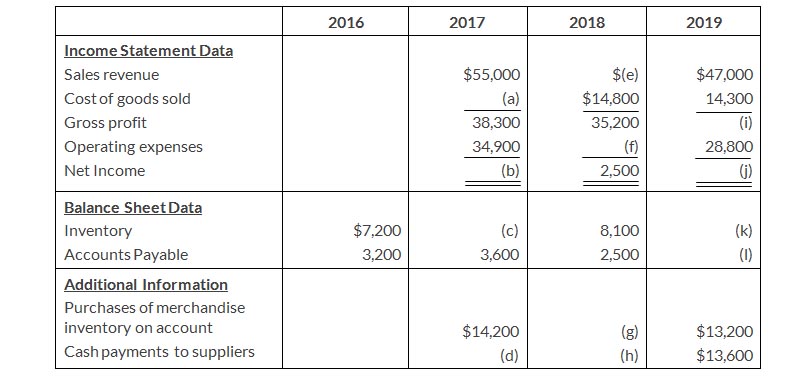

Instructions

- Calculate the missing amounts.

- Sales declined over the 3-year fiscal period, 2017-2019. Does that mean that profitability necessarily also declined? Explain, computing the gross profit rate and the profit margin(Net income + Sales revenue) for each fiscal year to help support your answer (Round to one decimal place.)

Read more: Problem-7: Accounting for Merchandising Operations

| April 5 | Purchased golf bags, clubs, and balls on account from Tiger Co. $1,200, FOB shipping point, terms 2/10, n/60. |

| 7 | Paid freight on Tiger Co. purchases $50. |

| 9 | Received credit from Tiger Co. for merchandise returned $100. |

| 10 | Sold merchandise on account to customers $600, terms n/30. |

| 12 | Purchased golf shoes, sweaters, and other accessories on account from Classic sportswear $450, terms 1/10, n/30. |

| 14 | Paid Tiger Co. in full. |

| 17 | Received credit from Classic Sportswear for merchandise returned $50. |

| 20 | Made sales on account to customers $600, terms n/30. |

| 21 | Paid Classic Sportswear in full. |

| 27 | Granted credit to customers for clothing that had flaws $35. |

| 31 | Received payments on account from customers $600. |

The chart of accounts for the pro shop includes Cash, Accounts Receivable, Inventory, Accounts Payable, Owner's Capital, Sales Revenue, Sales Returns and Allowances, Purchase Returns and Allowances, Purchase Discounts, and Freight In.

Instructions

- Journalize the April transactions using a perpetual inventory system.

- Using T-accounts, enter the beginning balances in the ledger accounts and post the April transactions.

- Prepare a trial balance on April 30, 2019.

- Prepare an income statement through gross profit, assuming merchandise inventory on hand at April 30 is $4,824.

Read more: Problem-8: Accounting for Merchandising Operations

- On April 5, purchased merchandise from Wilkes Company for $23,000, terms 2/10, net/30, FOB shipping point

- On April 6, paid freight costs of $900 on merchandise purchased from Wilkes.

- On April 7, purchased equipment on account for $26,000.

- On April 8, returned damaged merchandise to Wilkes Company and was granted a $3,000 credit for returned merchandise.

- On April 15, paid the amount due to Wilkes Company in full.

Instructions

- Prepare the Journal entries to record these transactions on the books of Kerber Co. under a perpetual inventory system.

- Assume that Kerber Co. paid the balance due to Wilkes Company on May 4 instead of April 15. Prepare the journal entry to record this payment.

Read more: Problem-9: Accounting for Merchandising Operations

| Sept. 6 | Purchased 90 calculators at $22 each from York, terms net/30. |

| 9 | Paid freight of $90 on calculators purchased from York Co. |

| 10 | Returned 3 calculators to York Co. for $69 credit (including freight) because they did not meet specifications. |

| 12 | Sold 26 calculators costing $23 (including freight) for $31 each to Sura Book Store, terms n/30. |

| 14 | Granted credit of $31 to Sura Book Store for the return of one calculator that was not ordered. |

| 20 | Sold 30 calculators costing $23 for $32 each to Davis Card Shop, terms n/30. |

Instructions

Read more: Problem-10: Accounting for Merchandising Operations