During 2020, the following selecterd cash transactions occurred.

| April 1 | Purchased land for $2,130,000. |

| May 1 | Sold equipment that cost $750,000 when purchased on January 1, 2016. The equipment was sold for $450,000. |

| June 1 | Sold land purchased on June 1, 2010 for $1,500,000. The land cost $400,000. |

| July 1 | Purchased equipment for $2,500,000. |

| Dec. 1 | Retired equipment that cost $500,000 when purchased on December 31, 2010. The company received no proceeds related to salvage. |

Instructions

- Journalize the above transactions. The company uses straight-line depreciation for buildings and equipment. the buildings are estimated to have a 50-year life and no salvage value. The equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation on assets disposed of at the time of sale or retirement.

- Record adjusting entries for depreciation for 2020.

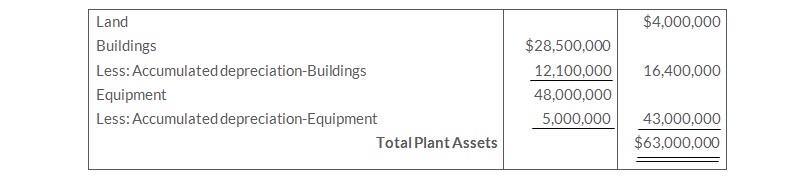

- Prepare the plant assets section of Grand's balance sheet at December 31, 2020.

Solution

Journal entries

Adjusting entries

Balance Sheet (Partial)

December 31, 2020