| Debit | ||

| 1. | Cost of filling and grading the land | $4,000 |

| 2. | Full payment to building contractor | 690,000 |

| 3. | Real estate taxes on land paid or the current year | 5,000 |

| 4. | Cost of real estate purchased as a plant site (land $100,000 and building $45,000) | 145,000 |

| 5. | Excavation costs for new building | 35,000 |

| 6. | Architect's fees on building plans | 10,000 |

| 7. | Accrued real estate taxes paid at time of purchase of real estate | 2,000 |

| 8. | Cost of parking lots and driveways | 14,000 |

| 9. | Cost of demolishing building to make land suitable for construction of new building | 25,000 |

| $930,000 | ||

| Credit | ||

| 10. | Proceeds from salvage of demolished building | $3,500 |

Instructions

| Item | Land | Buildings | Other Accounts |

Read more: Problem-1: Plant Assets, Natural Resources and intangible Assets

| Bus | Acquired | Cost | Salvage Value | Useful Life in Years | Depreciation Method |

| 1. | 1/1/16 | $96,000 | $6,000 | 5 | Straight-line |

| 2. | 1/1/16 | 110,000 | 10,000 | 4 | Declining balance |

| 3. | 1/1/17 | 92,000 | 8,000 | 5 | units-of-activity |

For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 120,000. Actualy miles of use in the first 3 years were 2018, 24,000, 2019, 34,000, and 2020, 30,000

Instructions

- Compute the amount of accumulated depreciation on each bus at December 31, 2019

- If Bus 2 was purchased on April 1 instead of January 1,. What is the depreciation expense for this bus in (1) 2017 and (2) 2018?

Read more: Problem-2: Plant Assets, Natural Resources and intangible Assets

| Machine A: | The cash price of this machine was $48,000. Related expenditures included: sales tax $1,700, shipping costs $150, insurance during shipping $80, installation and testing costs $70, and $100 of oil and lubricants to be used with the machinery during its first year of operations. Evers estimates that the useful life of the machine is 5 years with a $5,000 salvage value remaining at the end of that time period. Assume that the straight-line method of depreciation is used. |

| Machine B: | The recorded cost of this machine was $180,000. Evers estimates that the useful life of the machine is 4 years with a $10,000 salvage value remaining at the end of that time period |

Instructions

- Prepare the following for Machine A

- The journal entry to record its purchase on January 1, 2019

- The journal entry to record annual depreciation at December 31, 2019.

- Calculate the amount of depreciation expense that Evers should record for Machine B each year of its useful life under the following assumptions.

- Evers uses the straight-line method of depreciation.

- Evers uses the declining-balance method. The rate used is twice the straight-line rate.

- Evers uses the units-of-activity method and estimates that the useful life of the machine is 125,000 units. Actual usage is as follows: 2019, 45,000 units: 2020, 35,000 units: 2021, 25,000 units: 2022, 20,000 units.

- Which method used to calculate depreciation on Machine B reports the highest amount of depreciation expense year 1 (2019)? The highest amount in year 4 (2022)? The highest total amount over the 4-year period?

Read more: Problem-3: Plant Assets, Natural Resources and intangible Assets

At the beginning of 2015, Mazzaro Company acquired equipment costing $120,000. It was estimated that this equipment would have a useful life of 6 years and a salvage value of $12,000 at that time. The straight-line method of depreciation was considered the most appropriate to use with this type of equipment. Depreciation is to be recorded at the end of each year.

During 2021(the third year of the equipment’s life), the company’s engineers reconsidered their expectations, and estimated that the equipment’s useful life would probably be 7 years (in total) instead of 6 years,. The estimated salvage value was not changed at that time. However, during 2025 the estimated salvage value was reduced to $5,000.

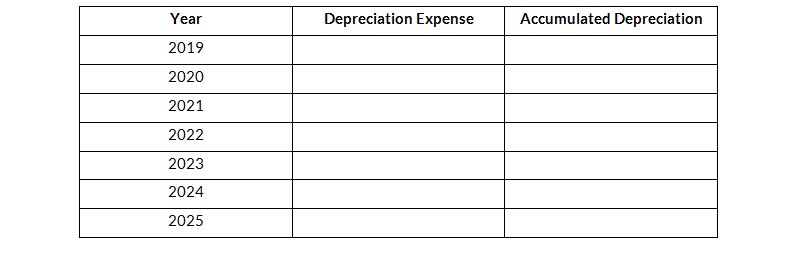

Instructions

Indicate how much depreciation expense should be recorded each year for this equipment, by completing the following table.

Read more: Problem-4: Plant Assets, Natural Resources and intangible Assets

During 2020, the following selecterd cash transactions occurred.

| April 1 | Purchased land for $2,130,000. |

| May 1 | Sold equipment that cost $750,000 when purchased on January 1, 2016. The equipment was sold for $450,000. |

| June 1 | Sold land purchased on June 1, 2010 for $1,500,000. The land cost $400,000. |

| July 1 | Purchased equipment for $2,500,000. |

| Dec. 1 | Retired equipment that cost $500,000 when purchased on December 31, 2010. The company received no proceeds related to salvage. |

Instructions

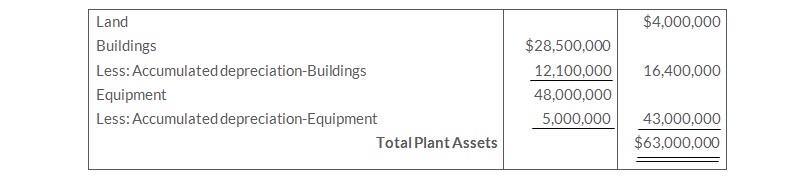

- Journalize the above transactions. The company uses straight-line depreciation for buildings and equipment. the buildings are estimated to have a 50-year life and no salvage value. The equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation on assets disposed of at the time of sale or retirement.

- Record adjusting entries for depreciation for 2020.

- Prepare the plant assets section of Grand's balance sheet at December 31, 2020.

Read more: Problem-5: Plant Assets, Natural Resources and intangible Assets

Instructions

Record the disposal under the following assumptions.

- It was scrapped as having no value.

- It was sold for $21,000.

- It was sold for $31,000

Read more: Problem-6: Plant Assets, Natural Resources and intangible Assets

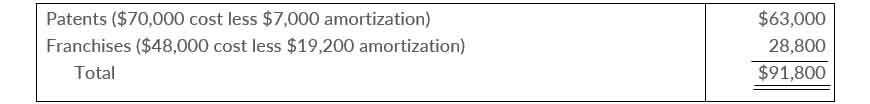

The patent was acquired in January 2019 and has a useful life of 10 years. The franchise was acquired in January 2016 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2020

| Jan. 2 | Paid $27,000 legal costs to successfully defend the patent against infringement by another company. |

| Jan.-June | Developed a new product, incurring $140,000 in research and development costs. A patent was granted for the product on July 1. Its useful life is equal to its legal life. |

| Sept. 1 | Paid $50,000 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials will air in September and October. |

| Oct. 1 | Acquired a franchise for $140,000. The franchise has a useful life of 50 years. |

Instructions

- Prepare journal entries to record the transactions above.

- Prepare journal entries to record the 2020 amortization expense.

- Prepare the intangible assets section of the balance sheet at December 31, 2020.

Read more: Problem-7: Plant Assets, Natural Resources and intangible Assets

Due to rapid turnover in the accounting department, a number of transactions involving intangible assets were improperly recorded by Goins Company in 2019.

- Goins developed a new manufacturing process, incurring research and development costs of $136,000. The company also purchased a patent for $60,000. In early January, Goins capitalized $196,000 as the cost of the patents. Patent amortization expense of $19,600 was recorded based on a 10-year useful life.

- On July 1, 2019, Goins purchased a small company and as a result acquired goodwill of $92,000. Goins recorded a half-year's amortization in 2019., based on a 50-year life ($920 amortization). The goodwill has an indefinite life.

Instructions

Prepare all journal entries necessary to correct any errors made during 1019. Assume the books have not yet been closed for 2019.

Read more: Problem-8: Plant Assets, Natural Resources and intangible Assets

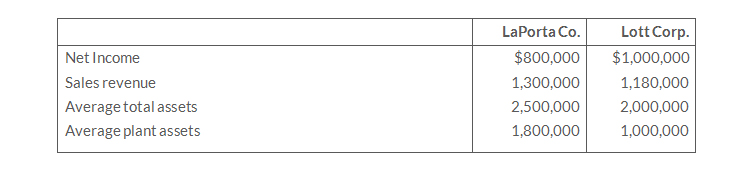

Instructions

- For each company, calculate the asset turnover.

- Based on calculations in part (1), comment on the relative effectiveness of the two companies in using their assets to generate sales and produce net income.

Read more: Problem-9: Plant Assets, Natural Resources and intangible Assets

The following expenditures relating to plant assets were made by Prather Company during the first 2 months of 2019.

- Paid $5,000 of accrued taxes at time plant site was acquired.

- Paid $200 insurance to cover possible accident loss on new factory machinery while the machinery was in transit.

- Paid $850 sales taxes on new delivery truck.

- Paid $17,500 for parking lots and driveways on new plant site.

- Paid $250 to have company name and advertising slogan painted on new delivery truck.

- Paid $8,000 for installation of new factory machinery.

- Paid $900 for one-year accident insurance policy on new delivery truck.

- Paid $75 motor vehicle license fee on the new truck.

Instructions

- Explain the application of the historical cost principle in determining the acquisition cost of plant assets.

- List the numbers of the foregoing transactions, and opposite each indicate the account title to which each expenditure should be debited.

Read more: Problem-10: Plant Assets, Natural Resources and intangible Assets