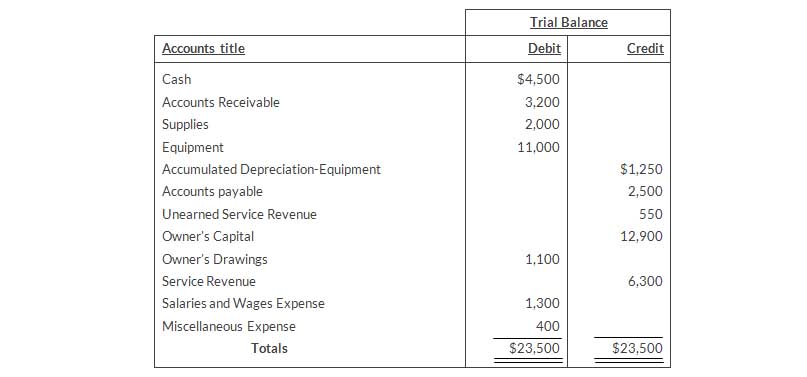

Worksheet

For the Month Ended March 31, 2019

- A physical count reveals only $480 of roofing supplies on hand

- Depreciation for March is $250.

- Unearned revenue amounted to $260 at March 31.

- Accrued salaries are $700.

Instructions

- Enter the trial balance on a worksheet and complete the worksheet.

- Prepare an income statement and owner's equity statement for the month of March and a classified balance sheet at March 31. T. Warren made an additional investment in the business of $10,000 in March.

- Journalize the adjusting entries from the adjustments columns of the worksheet

- Journalize the closing entries from the financial statement columns of the worksheet.

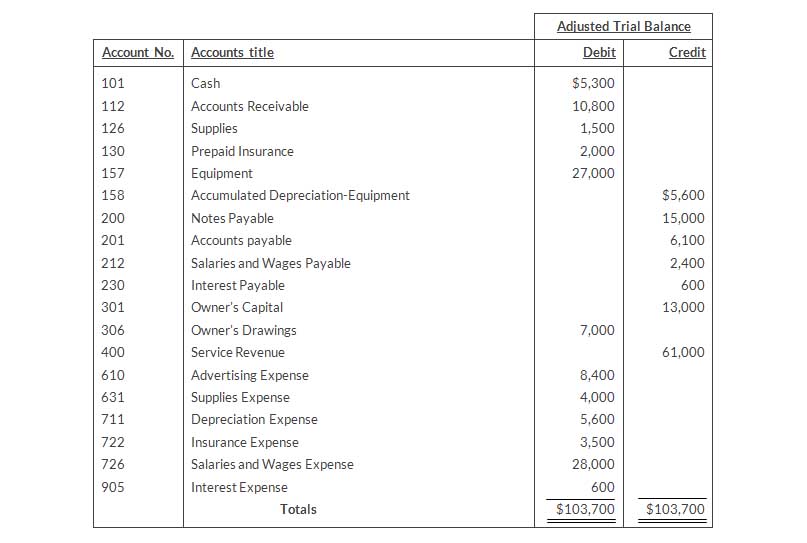

Worksheet

For the Year Ended December 31, 2019

Instructions

- Complete the worksheet by extending the balances to the financial statement columns.

- Prepare an income statement, owner's equity statement, and a classified balance sheet.(Note: $5,000 of the notes payable become due in 2020.) D. Thao did not make any additional investments in the business during the year.

- Prepare the closing entries. Use J14 for the journal page.

- Post the closing entries. Use the three-column form of account. Income Summary is No. 350.

- Prepare a post-closing trial balance.

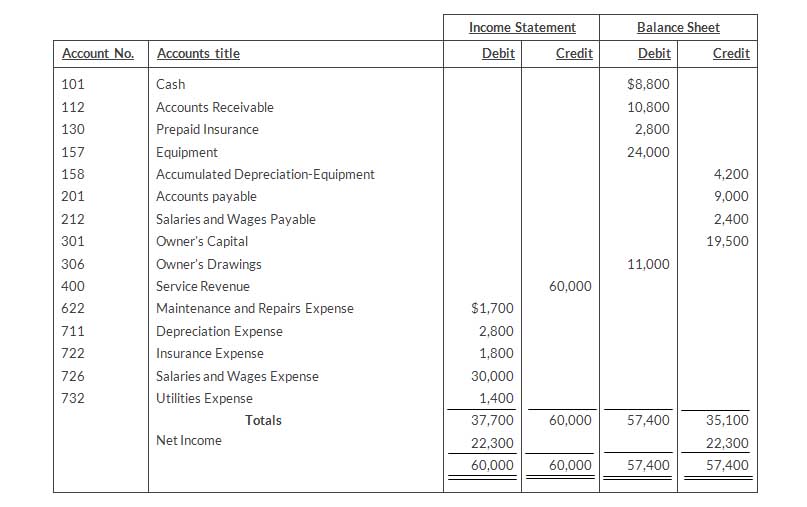

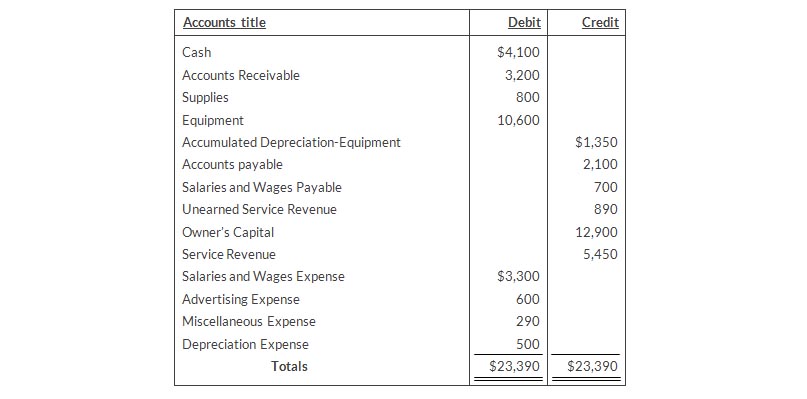

Worksheet

For the Year Ended December 31, 2019

Instructions

- Prepare an income statement, owner's equity statement, and a classified balance sheet.

- Prepare the closing entries.L. Bray did not make any additional investments during the year..

- Post the closing entries and underline and balance the accounts (Use T-accounts.). Income Summary is No. 350.

- Prepare a post-closing trial balance.

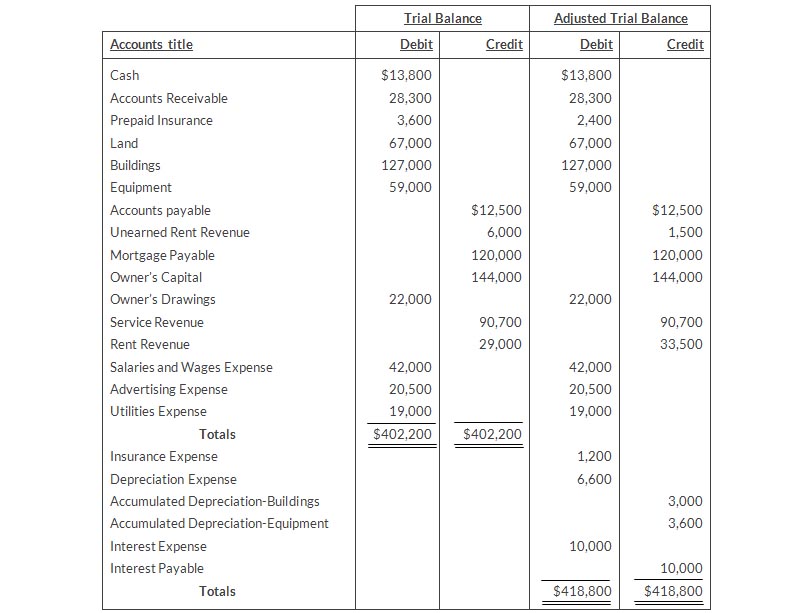

Worksheet

For the Year Ended December 31, 2019

Instructions

- Prepare a complete worksheet.

- Prepare a classified balance sheet.(Note: $30,000 of the mortgagenotes payable is due for payment next year.)

- Journalize the adjusting entries.

- Journalize the closing entries.

- Prepare a post-closing trial balance.

| July 1 | Anya invested $20,000 cash in the business. |

| 1 | Purchased used truck for $12,000, paying $4,000 cash and the balance on account. |

| 3 | Purchased cleaning supplies for $2,100 on account. |

| 5 | Paid $1,800 cash on a 1-year insurance policy effective July 1 |

| 12 | Billed customers $4,500 for cleaning services. |

| 18 | Paid $1,500 cash on amount owed on truck and $1,400 on amount owed on cleaning supplies. |

| 20 | Paid $2,800 cash for employee salaries. |

| 21 | Collected $3,400 cash from customers billed on July 12 |

| 25 | Billed customers $6,000 for cleaning services. |

| 31 | Paid $350 for the monthly gasoline bill for the truck. |

| 31 | Withdraw $5,600 cash for personal use. |

The chart of accounts for Anya’s Cleaning Service contains the following accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126 Supplies, No 130 Prepaid Insurance, No. 157 Equipment, No. 158 Accumulated Depreciation-Equipment, No. 201 Accounts Payable, No. 212 Salaries and Wages Payable, no. 301 Owner’s Capital, No. 306 Owner’s Drawings, No. 350 Income Summary, No. 400 Service Revenue, No. 631 Supplies Expense, no. 633 Gasoline Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 726 Salaries and Wages Expense.

Instructions

- Journalize and post the July transactions, Use page J1 for the journal and the three column form of account.

- Prepare a trial balance at July 31 on a worksheet.

- Enter the following adjustments on the worksheets and complete the worksheet.

- Unbilled and uncollected revenue for service performed at July 31 were $2,700.

- Depreciation on equipment for the month was $500.

- One-twelfth of the insurance expired.

- An inventory count shows $600 of cleaning supplies on hand at July 31.

- Accrued but unpaid employees salaries were $1,000.

- Prepare the income statement and owner’s equity statement for July and a classified balance sheet at July 31.

- Journalize and post adjusting entries. Use page J2 for the journal.

- Journalize and post closing entries and complete the closing process. Use page J3 for the journal.

- Prepare a post-closing trial balance at July 31.

Trial Balance

April 30, 2019

- Cash received from a customer on account was recorded as $950 instead of $590.

- A payment of $75 for advertising expense was entered as a debit to Miscellaneous Expense $75 and credit to Cash $75.

- The first salary payment this month was for $1,900, which included $700 of salaries payable on March 31. The payment was recorded as a debit to Salaries and Wages Expense $1,900 and a credit to Cash $1,900. (No reversing entries were made on April 1.)

- The purchase on account of a printer costing $310 was recorded as a debit to Supplies and a credit to Accounts Payable for $310.

- A cash payment of repair expense on equipment for $96 was recorded as a debit to Equipement $69 and a credit to Cash $69.

Instructions

- Prepaire an analysis of each error showing (1) the incorrect entry, (2) the correct entry, and (3) the correcting entry Items 4 and 5 occurred on April 30, 2019.

- Prepare a correct trial balance.