Trial Balance

April 30, 2019

- Cash received from a customer on account was recorded as $950 instead of $590.

- A payment of $75 for advertising expense was entered as a debit to Miscellaneous Expense $75 and credit to Cash $75.

- The first salary payment this month was for $1,900, which included $700 of salaries payable on March 31. The payment was recorded as a debit to Salaries and Wages Expense $1,900 and a credit to Cash $1,900. (No reversing entries were made on April 1.)

- The purchase on account of a printer costing $310 was recorded as a debit to Supplies and a credit to Accounts Payable for $310.

- A cash payment of repair expense on equipment for $96 was recorded as a debit to Equipement $69 and a credit to Cash $69.

Instructions

- Prepaire an analysis of each error showing (1) the incorrect entry, (2) the correct entry, and (3) the correcting entry Items 4 and 5 occurred on April 30, 2019.

- Prepare a correct trial balance.

Solution

Analysis of Adjusting Entries

(Determination of errors)

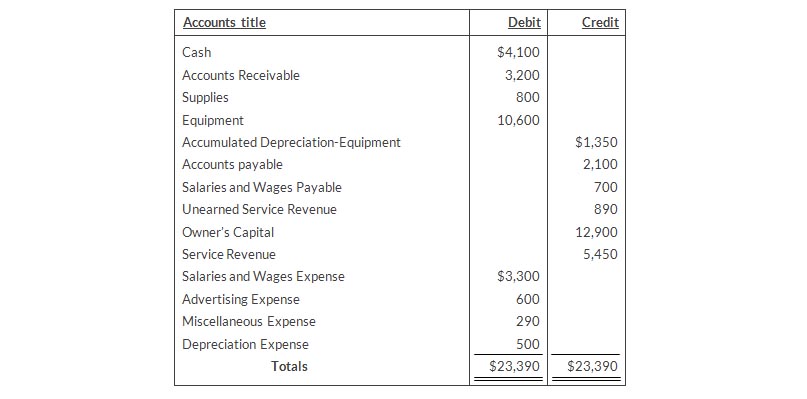

Corrected Trial Balance

April 30, 2019