Instructions

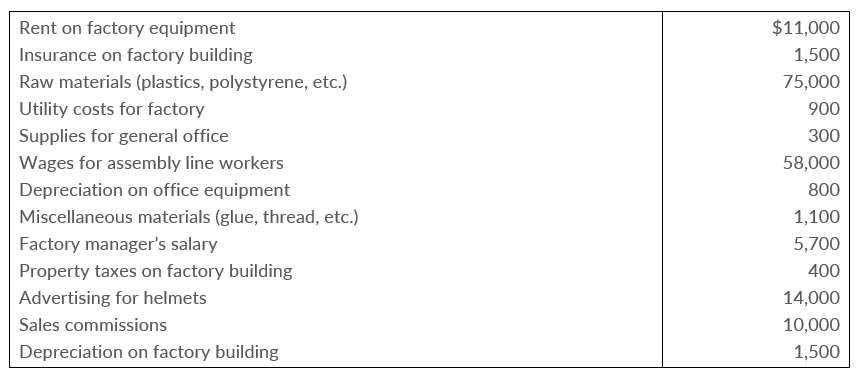

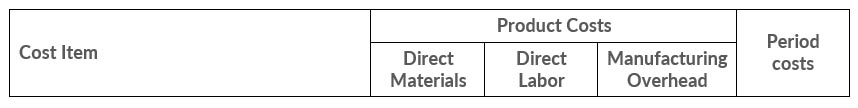

- Prepare an answer sheet with the following column headings.

Enter each cost item on your answer sheet, placing the dollar amount under the appropriate headings. Total the dollar amounts in each of the columns. - Compute the cost to product one helmet

Bell company, a manufacturer of audio systems, started its production in October 2020. Fort the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets. Bell decided to turn its retail store into an audio equipment factory.

Raw materials cost for an audio system will total $74 per unit. Workers on the production lines are on average paid $12 per hour. An audio system usually takes 5 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $4,900 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,000.

Factory janitorial costs are $1,300 monthly. Advertising costs for the audio system will be $9,500 per month. The factory building depreciation expense is $7,800 per year property taxes on the factory building will be $9,0000 per year.

Instructions

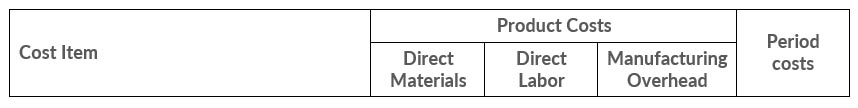

- Prepare an answer sheet with the following column headings.

Assuming that Bell manufactures, on average, 1,500 audio systems per month, entereach cost item on year answersheeet, placing the dollar amount per month under the appropriate headings. Total the dollar amounts in each of the columns - Compute the cost to produce one audio system

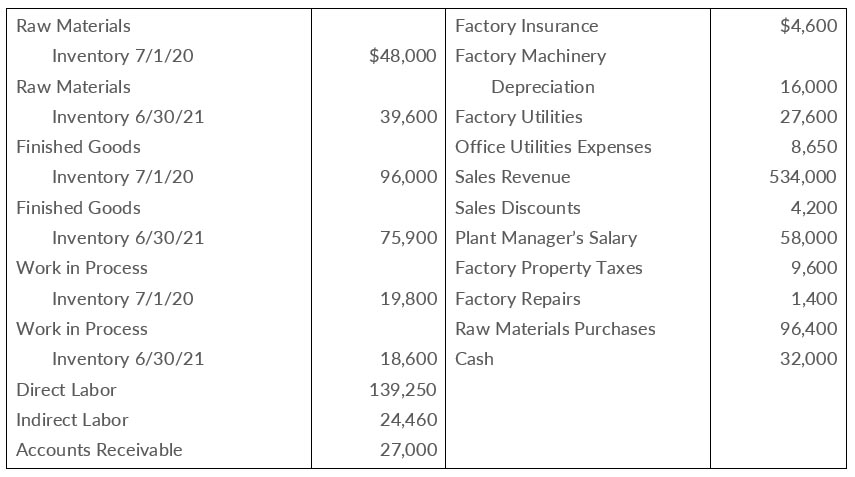

Instructions

- Indicate the missing amount for each letter..

- Prepare a condensed cost fo goods manufactured schedule for Case 1.

- Prepare an income statement and the current assets section of the balance sheet for Case 1. Assume that in case the other items in the current assets section are as follows Cash $3,000, Receivables (net) $15,000, Raw materials $600,and Prepare Expenses $400.

Instructions

- Prepare a cost of goods manufactured schedule (Assume all raw materials used were direct materials.)

- Prepare an income statement through gross profit.

- Prepare the current assets section of the balance sheet at June 30, 2021

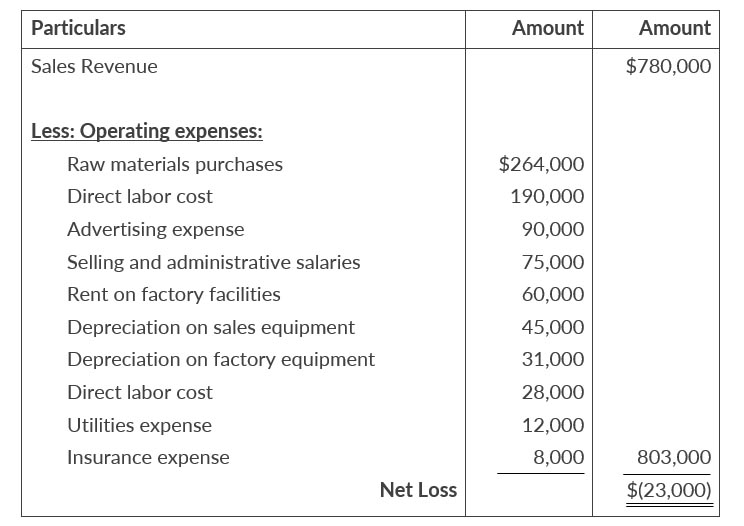

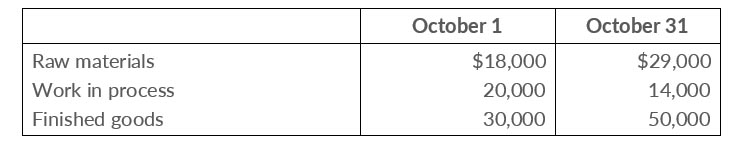

- Inventory balances at the beginning and end of October were:

- Only 75% of the utilities expense and 60% of the insurance expense apply to factory operations. The remaining amounts should be charged to selling and administrative activities

Instructions

- Prepare a schedule of cost of goods manufactured for October 2020.

- Prepare an correct income statement for October 2020.

- Salaries for assemble line inspectors.

- Insurance on factory machines

- Property taxes on the factory building.

- Factory repairs.

- Upholstery used in manufacturing furniture.

- Wages paid to assemble line workers.

- Factory machinery depreciation.

- Glue, nails, paint, and other small parts used in products.

- Factory supervisors' salaries.

- Wood used in manufacturing furniture.

Instructions

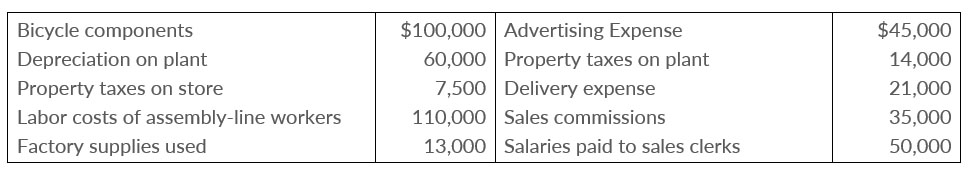

Instructions

- Identify each of the above costs as direct materials, direct labor, manufacturing overhead, or period costs.

- Explain the basic difference in accounting for product costs and period costs.

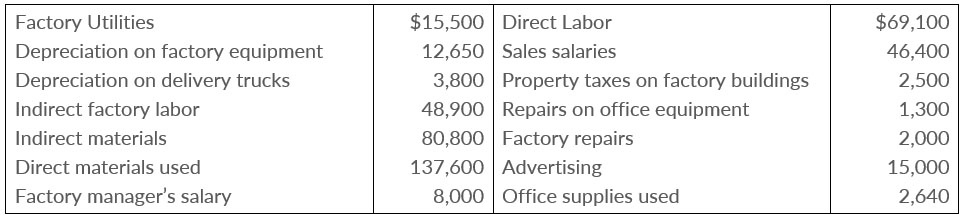

Instructions

From the information, determine the total amount of:

- Manufacturing Overhead

- Product Costs

- Period Costs

- Property taxes on the factory building

- Production superintendents salaries

- Memory boards and chips used in assembling computers.

- Depreciation on the factory equipment

- Salaries for assembly-line quality control inspectors.

- Sales commissions paid to sell laptop computers.

- Electrical components used in assembling computers.

- Wages of workers assembling laptop computers.

- Soldering materials used on factory assembly lines.

- Salaries for the night security guards for the factory building.

The company intends to classify these costs and expenses into the following categories: (a) direct materials, (b) direct labor, (c) manufacturing overhead, and (d) period costs

Instructions

- Salaries for the X-ray machine technicians.

- Wages for the hospital janitorial personnel

- Film costs for the X-ray machines

- Property taxes on the hospital building.

- Salary of the X-ray technicians' supervisor.

- Electricity costs for the X-ray department.

- Maintenance and repairs on the X-ray machines.

- X-ray department supplies.

- Depreciation on the X-ray department equipment.

- Depreciation on the hospital building.

The administrator want these costs and expenses classified as (a) Direct materials, (b) Direct labor, or (c) Service overhead