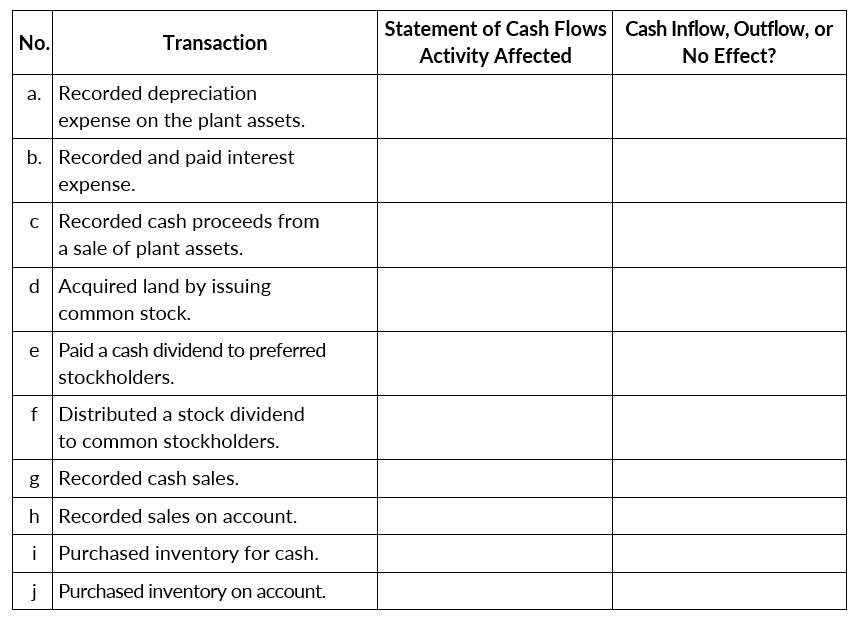

You are provided with the following transactions that took place during a recent fiscal year.

Instructions

The following account balances relate to the stockholders equity accounts of Kerbs Corp. at year-end.

| 2020 | 2019 | |

| Common stock, 10500 and 10,000 shares, respectively for 2020 and 2019. | $170,000 | $140,000 |

| Preferred stock, 5,000 shares | 125,000 | 125,000 |

| Retained earnings | 300,000 | 300,000 |

A small stock dividend was declared and issued in 2020. The market value of the shares was $10,500, cash dividends were $15,000 in both 2020 and 2019. The common stock has no par or stated value.

Instructions

- What was the amount of net income reported by Kerbs Corp. in 2020?

- Determine the amounts of any cash inflows or outflows related to the common stock and dividend accounts in 2020.

- Indicate where each of the cash inflows or outflows identified in (b) would be classified on the statement of cash flows

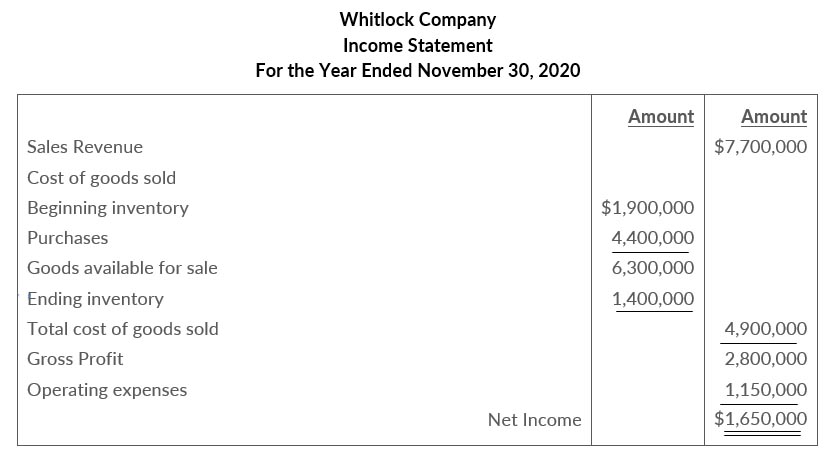

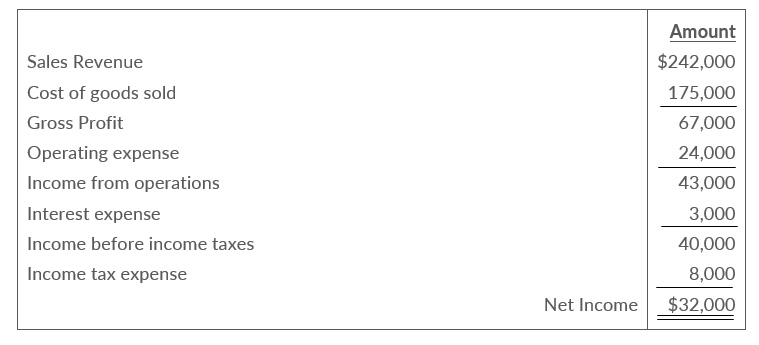

The income statement of Whitlock Company is presented here.

Additional information

- Accounts receivable increased $200,000 during the year, and inventory decreased $500,000.

- Prepaid expenses increased $150,000 during the year

- Accounts payable to suppliers of merchandise decreased $340,000 during the year.

- Accrued expenses payable decreased $100,000 during the year.

- Operating expenses include depreciation expense of $70,000

Instructions

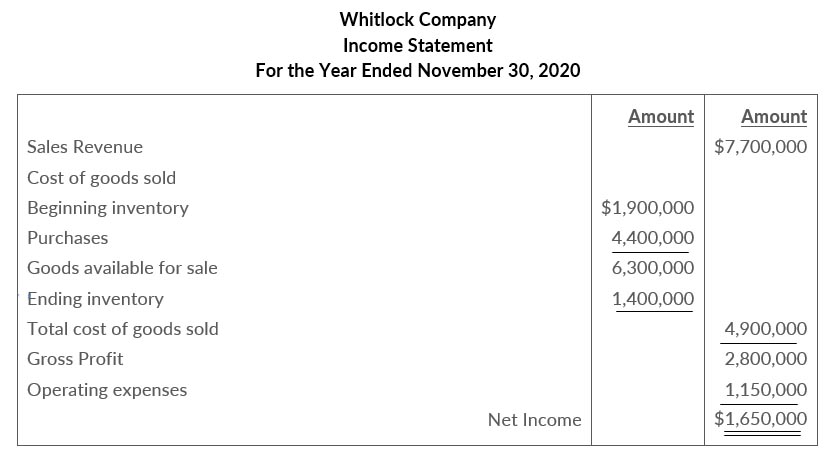

Data for Whitlock Company are presented below

Additional information

- Accounts receivable increased $200,000 during the year, and inventory decreased $500,000.

- Prepaid expenses increased $150,000 during the year

- Accounts payable to suppliers of merchandise decreased $340,000 during the year.

- Accrued expenses payable decreased $100,000 during the year.

- Operating expenses include depreciation expense of $70,000

Instructions

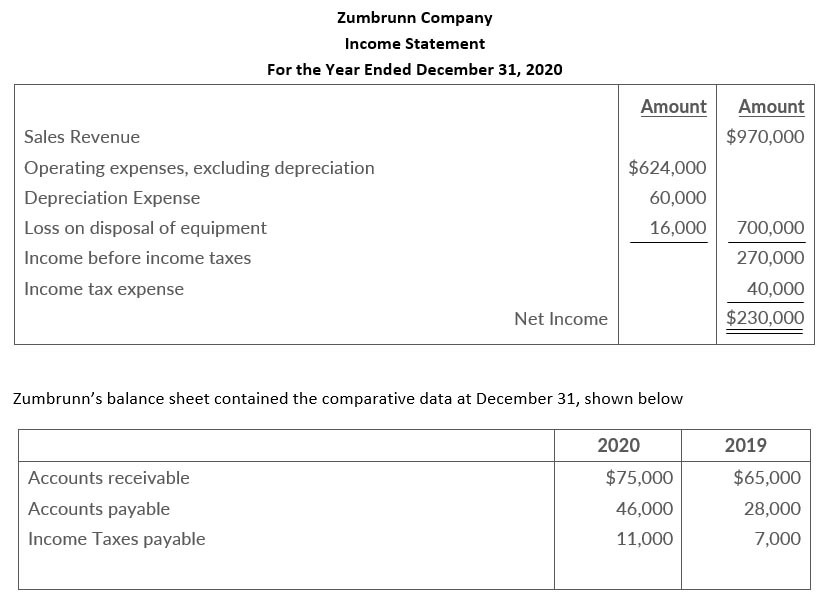

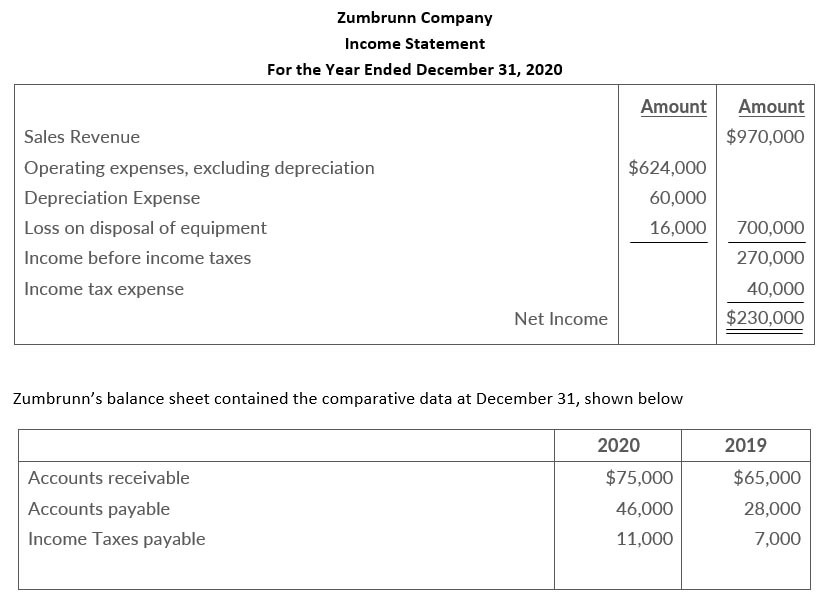

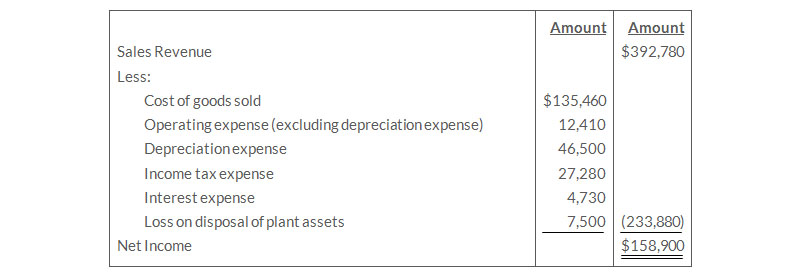

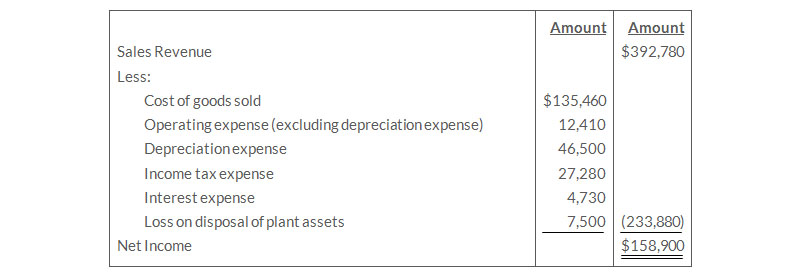

Zumbrunn Company's income statement contained the condensed information below.

Accounts payable pertain to operating expenses.

Instructions

Accounts payable pertain to operating expenses.

Instructions

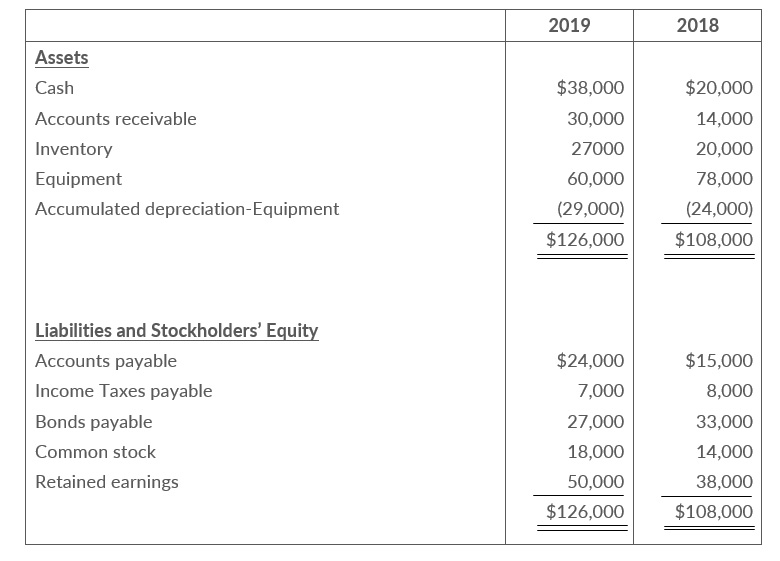

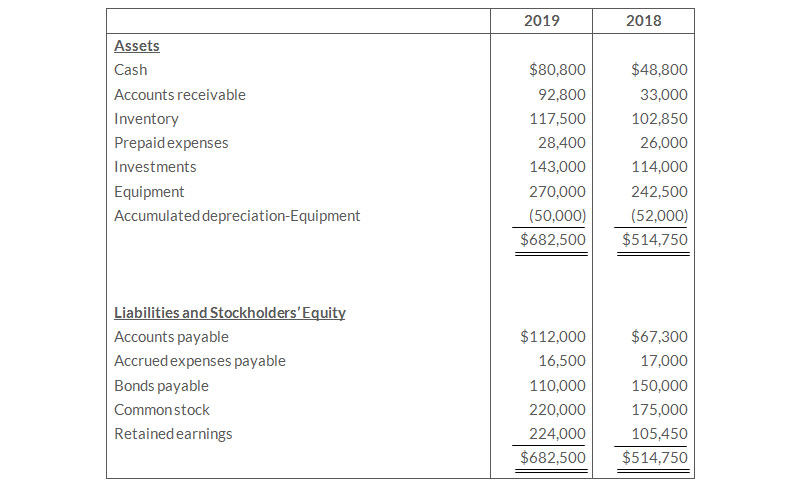

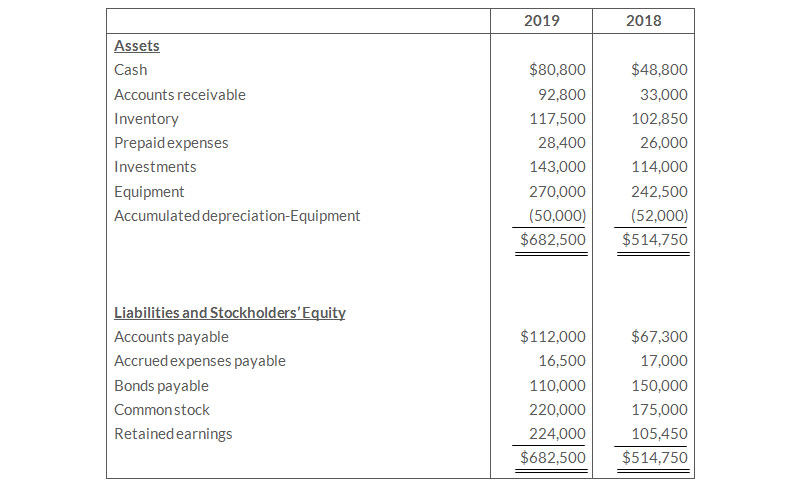

The following are the financial statements of Nosker Company.

Comparative Balance Sheets

December 31

Income Statement

For the Year Ended December 31, 2020

- Dividends declared and paid were $20,000.

- During the year equipment wassold for $8,500 cash. This equipment coast $18,000 originally and had a book value of $8,500 is in the operating expenses

- All depreciation expense $14,500 is in the operating expenses

- All sales and purchasers and on account.

Instructions

- Prepare a statement of cash flows using the indirect method.

- Compute free cash flow

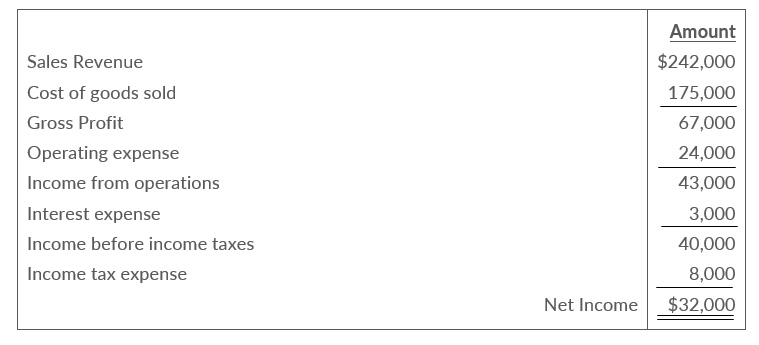

Data for Nosker Company are presented in bellow.

Comparative Balance Sheets

December 31

Income Statement

For the Year Ended December 31, 2020

- Dividends declared and paid were $20,000.

- During the year equipment wassold for $8,500 cash. This equipment coast $18,000 originally and had a book value of $8,500 is in the operating expenses

- All depreciation expense $14,500 is in the operating expenses

- All sales and purchasers and on account.

- Accounts payable pertain to merchandise suppliers.

- All operating expenses except for depreciation were paid in cash

Instructions

- Prepare a statement of cash flows for Nosker Company using the direct method.

- Compute free cash flow

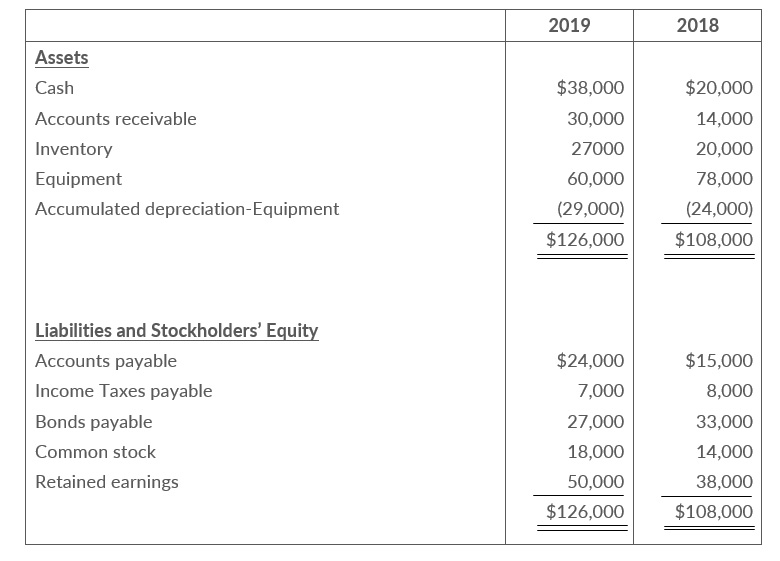

Condensed financial data of Cheng Inc. follow.

Comparative Balance Sheets

December 31

Income Statement

For the Year Ended December 31, 2019

- New equipment costing $85,000 was purchased for cash during the year.

- Old equipment having an original cost of $57,500 was sold for $1,500 cash.

- Bonds matured and were paid off at face value for cash.

- A cash dividend of $40,350 was declared and paid during the year.

Instructions

Data for cheng In. are presented in.

Comparative Balance Sheets

December 31

Income Statement

For the Year Ended December 31, 2019

- New equipment costing $85,000 was purchased for cash during the year.

- Old equipment having an original cost of $57,500 was sold for $1,500 cash.

- Bonds matured and were paid off at face value for cash.

- A cash dividend of $40,350 was declared and paid during the year.

Further analysis reveals that accounts payable pertain to merchandise creditors.