| Oct. 7 | Made sales of $6,900 on Farwell credit cards |

| 12 | Made sales of $900 on MasterCard credit cards. The credit card service charge is 3% |

| 15 | Added $460 to Farwell customer balances for finance charges on unpaid balances |

| 15 | Received payment in full from K. Goza Inc. on the amount due. |

| 24 | Received notice that the Holt note has been dishonored. (Assume that Holt is expected to pay in the future |

Instructions

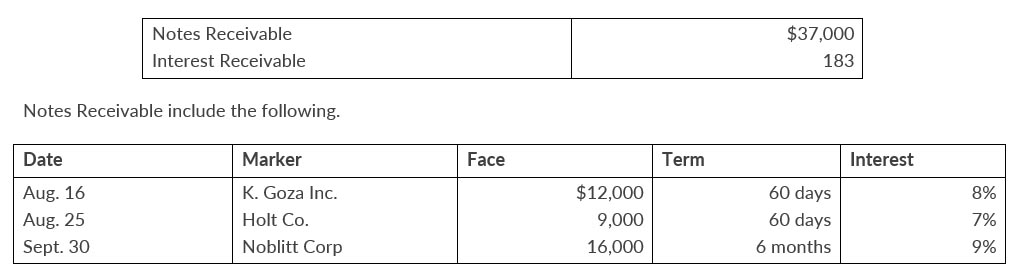

- Journalize the October transactions and the October 31 adjusting entry for accrued interest receivable.

- Enter the balances at October 1 in the receivable accounts. Post the entries to all of the receivable accounts. There was no opening balance in accounts receivable.

- Show the balance sheet presentation of the receivable accounts at October 31

Solution

Journal Entries

Balance Sheet (Partial)