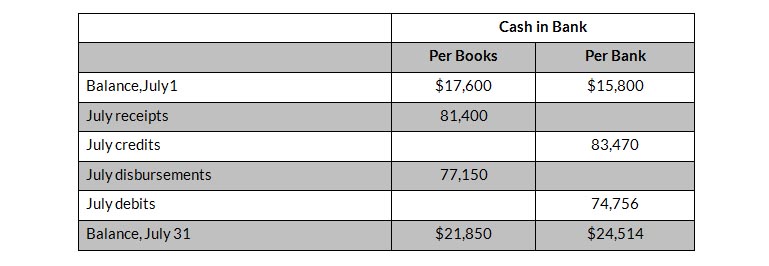

Analysis of the bank data reveals that the credits consist of $79,000 of July deposits and a credit memorandum of $4,470 for the collection of a $4,400 note plus interest revenue of $70.The July debits per bank consist of checks cleared $74,700 and a debit memorandum of $56 for printing additional company checks.

The following errors involving July checks.(1) A check for $230 to a creditor on account that cleared the bank in July was journalized and posted as $320.(2) A salary check to an employee for $255 was recorded by the bank for $155.

The June 30 bank reconciliation contained only two reconciling items: deposits in transit $8,000 and outstanding checks of $6,200.

Instructions

- Prepare a bank reconciliation at July 31,2019.

- Journalize the adjusting entries to be made by Rodriguez Company. Assume that interest on the note has not been accrued.

Solution

Bank Reconciliation Statement

July 31, 2019

Adjusting Entries