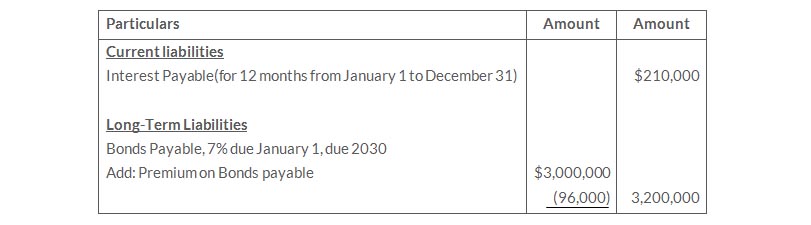

The following is taken from the Colaw Company balance sheet.

Interest is payable annually on January 1. The bonds are callable on any annual interest date. Colaw uses straight-line amortization for any bond premium or discount. From December 31, 2019, the bonds will be outstanding for an additional 10 years (120 months).

Instructions

- Journalize the payment of bond interest on January 1, 2020.

- Prepare the entry to amortize bond premium and to accrue the interest due on December 31, 2020.

- Assume that on January 1, 021, after paying interest, Colaw Company calls bonds having a face value of $1,200,000. the call price is 101. Record the redemption of the bonds.

- Prepare the adjusting entry at December 31, 2021, to amortize bond premium and to accrue interest on the remaining bonds.

Solution

Journal Entry

Journal Entry

Journal Entry

Adjusting Entry