- Raw materials inventory totaled $15,000 on January 1. During the year, $140,000 of raw materials were purchased on account.

- Finished goods on January 1 consisted of Job No. 7638 for $87,000 and Job No. 7639 for $92,000

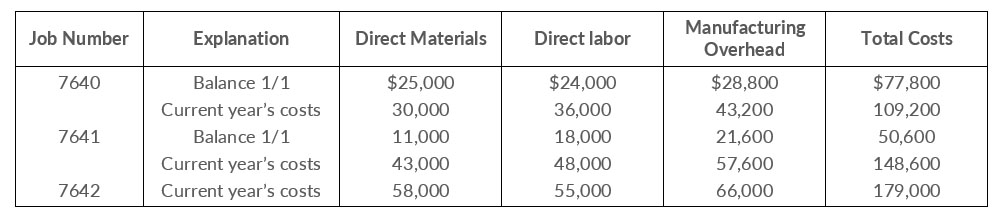

- Job No. 7640 and Job No. 7641 were completed during the year.

- Job Nos. 7638, 7639, and 7641 were sold on account for $530,000.

- Manufacturing overhead incurred on account totaled $120,000.

- Other manufacturing overhead consisted of indirect materials $14,000, indirect labor $18,000, and depreciation on factory machinery $8,000

Instructions

- Prove the agreement of Work in Process Inventory with job cost sheets pertaining to unfinished work. Calculate each of the following, then post each to the T-account: (1) beginning balance, (2) direct materials, (3) direct labor, (4) manufacturing overhead, and (5) completed jobs.

- Prepare the adjusting entry for manufacturing overhead, assuming the balance is allocated entirely to Cost of Goods Sold.

- Determine the gross profit to the reported for 2020.

Solution

Income Statement (Partial)

For the year ended December 31, 2020