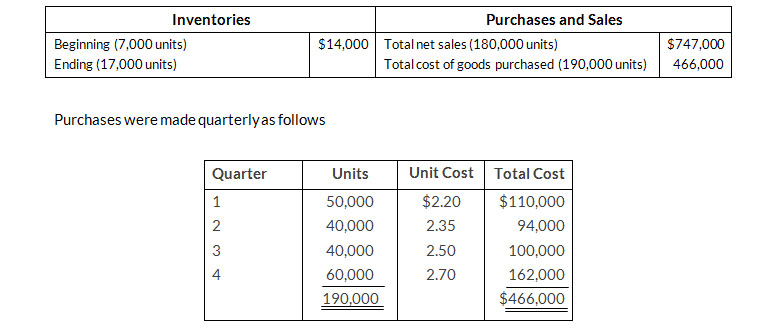

Operating expenses were $130,000, and the company's income tax rate is 40%.

Instructions

- Prepare comparative condensed income statements for 2019 under FIFO and LIFO(Show computations of ending inventory)

- Answer the following operations for management.

- Which cost flow method (FIFO or LIFO) produces the more meaningful inventory amount for the balance sheet? Why?

- Which cost flow method (FIFO or LIFO) produces the more meaningful net income? Why?

- Which cost flow method (FIFO or LIFO) is more likely to approximate the actually physical flow of goods? Why?

- How much more cash will be available for management under LIFO than under FIFO? Why?

- Will gross profit under the average-cost method be higher or lower than FIFO? Than LIFO? (Note: It is not necessary to quantify your answer)

Solution

Condensed Income Statement

For the year ended December 31, 2019

- FIFO method produces the more meaningful inventory amount for the balance sheet because the units are closed at the most recent purchase

- LIFO method produces the more meaningful net income for the balance sheet because the costs are closed at the most recent purchases against the sales

- FIFO method is more likely to approximate the actual physical flow of goods because the oldest goods are usually sold first to minimize damages and expired

- There will be $3,960 additional cash available for management under LIFO than under FIFO because income taxes are $69,200 under LIFO and $73,160 under FIFO

- Gross profit under the average-cost method will be lower than FIFO and higher than LIFO