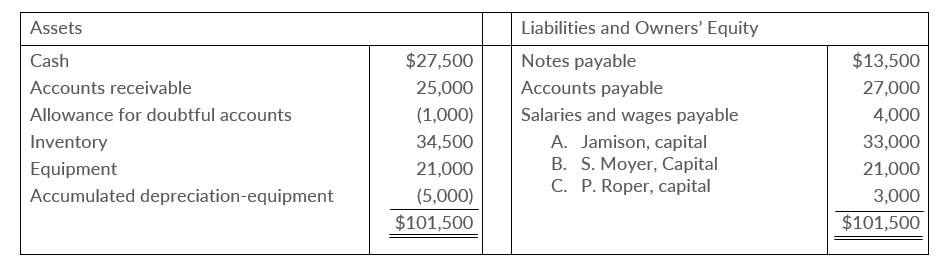

The partners in Crawford Company decide to liquidate the firm when the balance sheet shows the following.

May 31, 2021

The partners share income and loss 5:3:2. During the process of liquidation, the following transaction were competed in the following sequence.

- A total of $51,000 was received from converting noncash assets into cash.

- Gain or loss on realization was allocated to partners

- Liabilities were paid in full.

- P. Roper paid his capital deficiency.

- Cash was paid to the partners with credit balances.

Instructions

- Prepare the entries to record the transactions.

- Post to the cash and capital accounts.

- Assume that Roper is unable to pay the capital deficiency.

- Prepare the entry to allocate Roper's debit balance to Jamison and Moyer

- Prepare the entry to record the final distribution of cash.

Solution