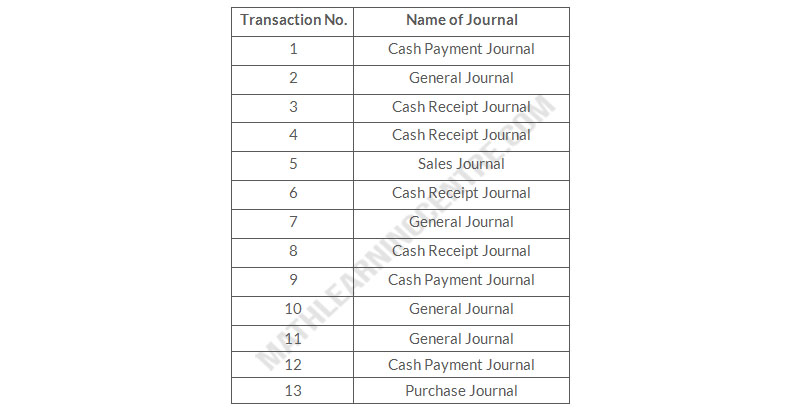

- Payment of creditors on account.

- Return of merchandise sold for credit.

- Collection on account from customers.

- Sale of land for cash.

- Sale of merchandise on account.

- Sale of merchandise for cash.

- Received credit for merchandise purchased on credit.

- Sales discount taken on goods sold.

- Payment of employee wages.

- Income summary closed to owner's capital.

- Depreciation on building.

- Purchase of office supplies for cash.

- Purchase of merchandise on account.

Instructions

For each transaction, indicate whether it would normally be recorded in a cash receipts journal, cash payments journal, sales journal, single-column purchases journal, or general journal.

Solution

Indications of Entries position