Case Inc. is a construction company specializing in custom patios. The patios are constructed of concrete, brick, fiberglass, and lumber, depending upon customer preference. In June 1, 2020, the general ledger for Case Inc. contains the following data.

| Raw Materials Inventory | $4,200 | Manufacturing Overhead Applied | $32,640 |

| Work in Process Inventory | $5,540 | Manufacturing Overhead Incurred | $31,650 |

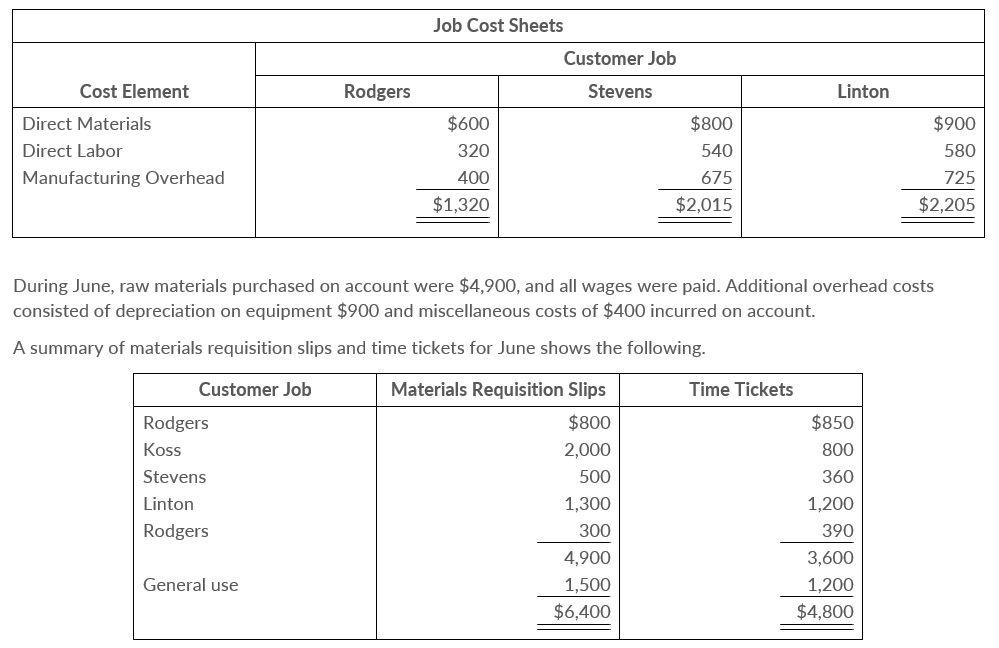

Subsidiary data for Work in Process Inventory on June 1 are as follows.

Overhead was charged to jobs at the same rate of $1.25 per dollar of direct labor cost. The patios for customers Rodgers, Stevens and Linton were completed during June and sold for a total of $18,900. Each customer paid in full.

Instructions

- Journalize the June transactions: (1) for purchase of raw materials, factory labor costs incurred, and manufacturing overhead costs incurred; (2) assignment of direct materials, labor; and overhead to production; and (3) completion of jobs and sale of goods.

- Post the entries to Work in Process Inventory.

- Reconcile the balance in Work in Process inventory with the costs of unfinished jobs.

- Prepare a cost of goods manufactured schedule for June

Solution

a.