On December 31, the adjusted trial balance of Shihata Employment Agency shows the following selected data.

| Accounts Receivable | $24,500 | Service Revenue | $92,500 |

| Interest Expense | 7,700 | Interest Payable | 2,200 |

Analysis shows that adjusting entries were made to (1) accrue $5,000 of service revenue and (2) accrue $2,200 interest expense.

Instructions

- Prepare the closing entries for the temporary accounts shows above at December 31.

- Prepare the reversing entries on January 1.

- Post the entries in (a) and (b). Underline and balance the accounts. (Use T-Accounts)

- Prepare the entries to record (1) the collection of the accrued revenue on January 10 and (2) the payment of all interest due ($3,000) on January 15.

- Post the entries in (d) to the temporary accounts.

Solution

a.

Shihata Employment Agency

Closing Journal Entries

Closing Journal Entries

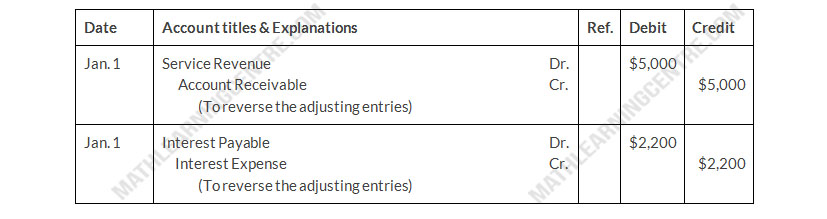

b.

Shihata Employment Agency

Reversing Journal Entries

Reversing Journal Entries

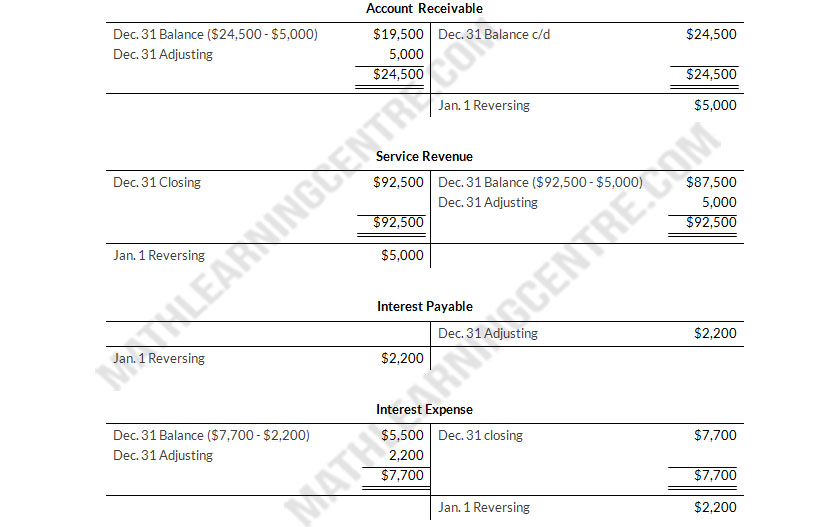

c.

Shihata Employment Agency

T-accounts

T-accounts

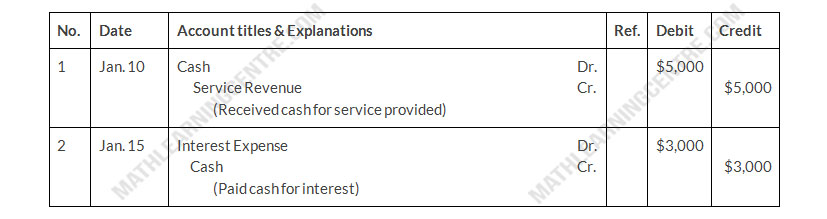

d.

Shihata Employment Agency

Journal Entries

Journal Entries

e.

Shihata Employment Agency

T-accounts

T-accounts