Deleon Inc. is preparing its annual budgets for the year ending December 31, 2023. Accounting assistants furnish the data shown below.

| Product JB 50 | Product JB 60 | ||

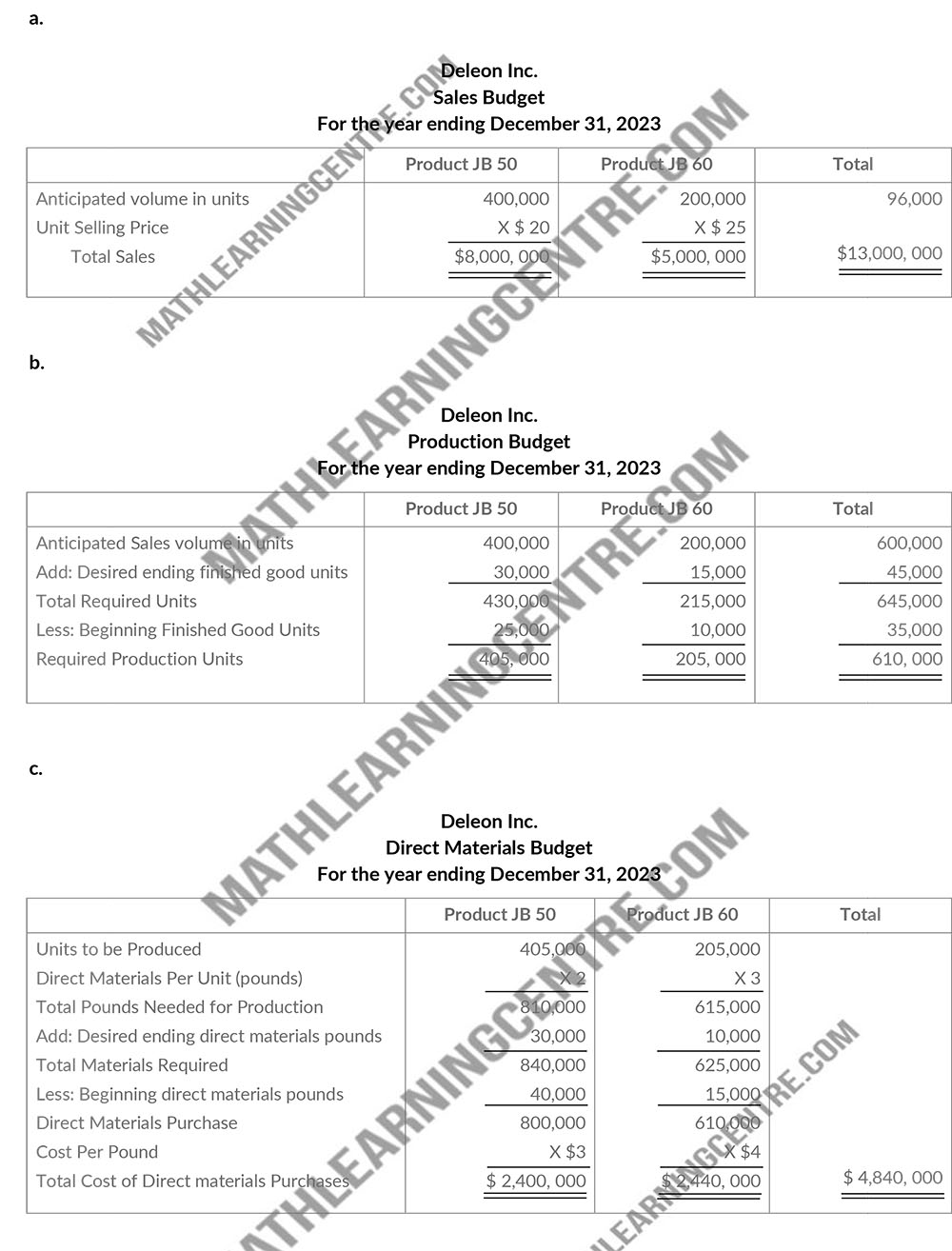

| Sales Budget: | |||

| Anticipated volume in units | 400,000 | 200,000 | |

| Unit selling price | $20 | $25 | |

| Production Budget: | |||

| Desired ending finished goods units | 30,000 | 15,000 | |

| Beginning finished goods units | 25,000 | 10,000 | |

| Direct materials Budget: | |||

| Direct materials per unit (pounds) | 2 | 3 | |

| Desired ending direct materials pounds | 30,000 | 10,000 | |

| Beginning direct materials pounds | 40,000 | 15,000 | |

| Cost per pound | $3 | $4 | |

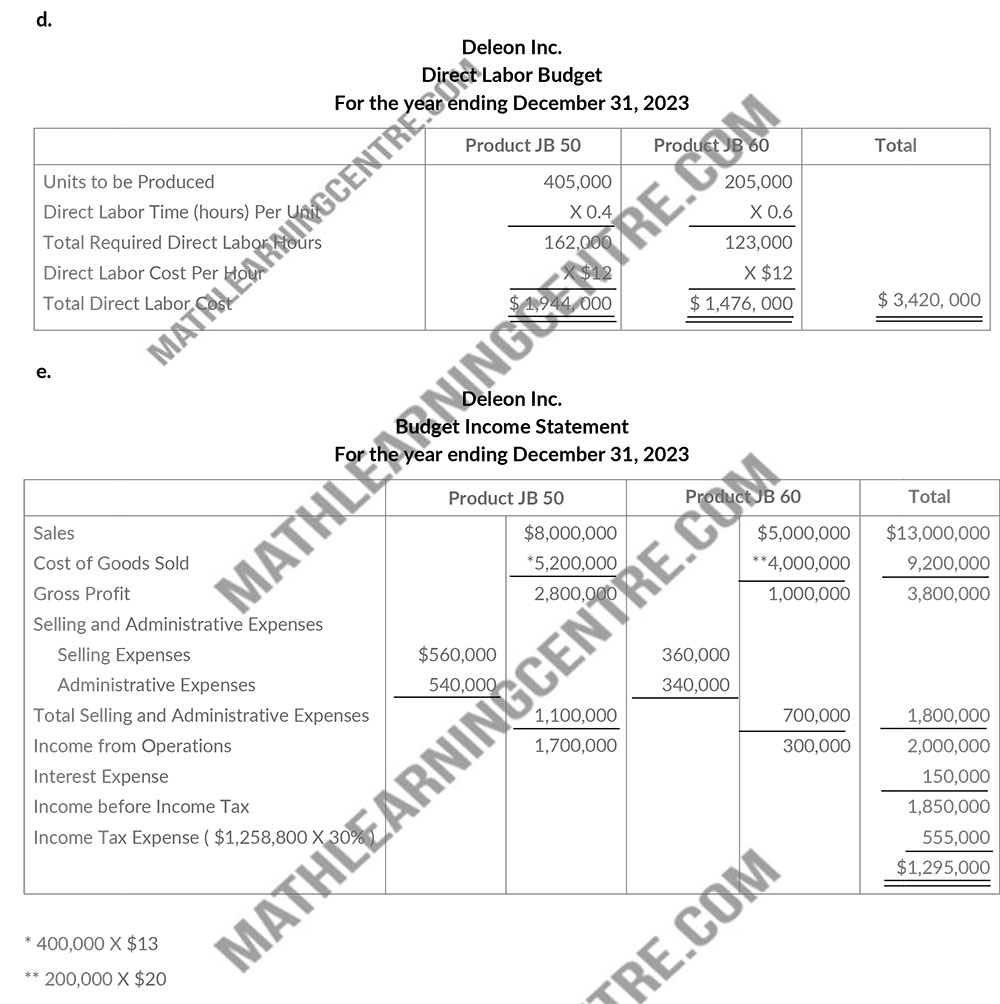

| Direct Labor Budget: | |||

| Direct labor time per unit | 0.4 | 0.6 | |

| Direct labor rate per unit | $12 | $12 | |

| Budgeted income statement:: | |||

| Total unit cost | $13 | $20 | |

An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget. The latter shows selling expenses of $560,000 for product JB 50 and $360,000 for product JB 60, and administrative expenses of $540,000 for product JB50 and $340,000 for product JB 60. Interest expenses is $150,000 (not allocated to products). Income taxes are expected to be 30%

Instructions

Prepare the following budgets for the year. Show data for each product. Quarterly budgets should not be prepared.

- Sales

- Production.

- Direct materials.

- Dirct labor.

- Income statement (Note: income taxes are not allocated to the products).

Solution