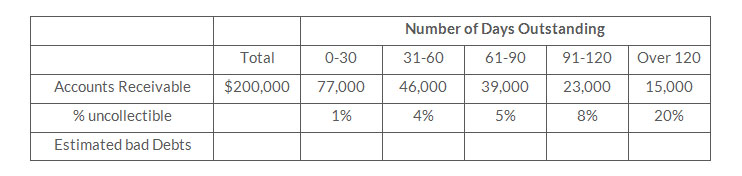

Rigney Inc. uses the allowance method to estimate uncollectable accounts receivable. The company produced the following aging of the accounts receivable at year-end.

Instructions

- Calculate the total estimated bad debts based on the above information.

- Prepare the year-end adjusting journal entry to record the bad debts using the aged uncollectable accounts receivable determined in (a). Assume the current balance in Allowance for Doubtful Accounts is a $8,000 debit.

- Of the above accounts, $5,000 is determined to be specifically uncollectable. Prepare the journal entry to write off the uncollectable account.

- The company collects $5,000 subsequently on a specific account that had previously been determined to be uncollectable in (c). Prepare the journal entry(ies) necessary to restore the account and record the cash collection.

- Comment on how your answers to (a)-(d) would change if Rigney Inc. used 4% of total accounts receivable rather than aging the accounts receivable. What are the advantages to the company of aging the accounts receivable rather than applying a percentage to total accounts receivable?

Solution

a.

Calculating of the total estimated bad debts

Solution of b., c. and d.

Journal Entries

e.